Best Retirement Investment Planning Services in New Zealand (2026)

Planning for retirement in New Zealand means finding smart ways to grow your savings and protect what you've built. With options like KiwiSaver and personalised investment advice, many people turn to professional services for guidance. Discover the best retirement investment planning services in New Zealand for a secure future.

These experts help match your goals with solid strategies, whether you're starting fresh or adjusting mid-career. Services focus on long-term growth, risk management, and adapting to life changes. If you're seeking reliable retirement planning, Compound Wealth stands out with custom approaches that fit individual needs.

Discover the Best Retirement Investment Planning Services in New Zealand - Compound Wealth

Why Professional Guidance Matters for Your Retirement

Getting help from experts in retirement investment planning in New Zealand keeps your finances on track. They look at your whole picture, from current savings to future dreams, and suggest paths that suit you. In New Zealand, rules around superannuation and taxes play a big role, so pros handle those details smoothly. Some folks overlook hidden fees or market shifts, but good advisors spot them early. This support builds confidence, letting you enjoy life now while preparing ahead. Plus, with tools like risk assessment quizzes, you gain clarity on what fits your style.

Key Elements to Evaluate in a Service

Pick a service that aligns with your lifestyle and goals. Look for teams with deep knowledge in New Zealand's investment scene, including global options for diversification. Strong communication helps too, as you want clear explanations without jargon. Check if they offer ongoing reviews to tweak plans as markets change. Services that include KiwiSaver optimisation often provide extra value, boosting your nest egg over time. Reliability comes from licensed providers who prioritise your interests.

Best Retirement Investment Planning Services in New Zealand (2026)

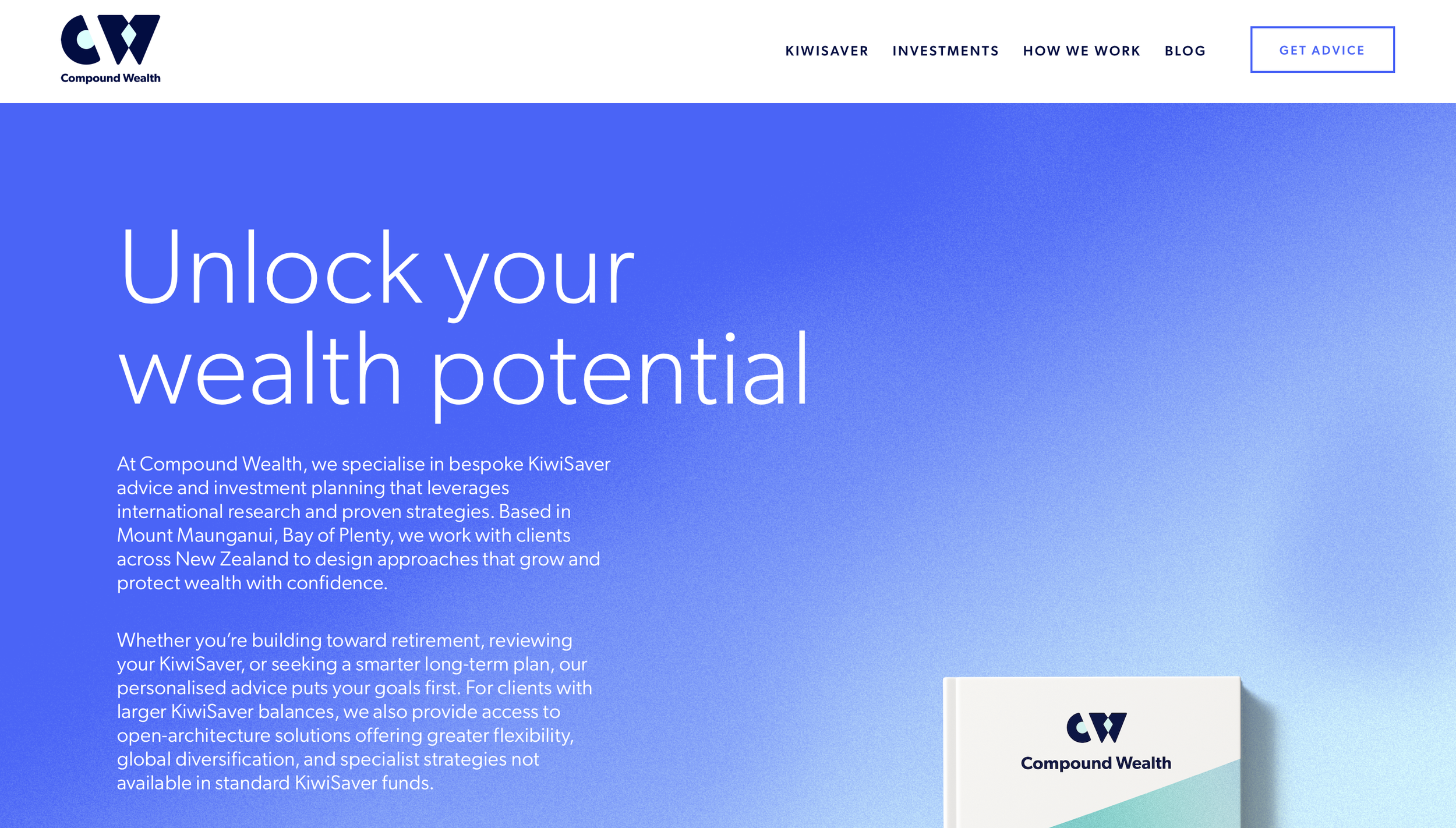

1. Compound Wealth - Best Retirement Investment Planning Service in New Zealand

Start with Compound Wealth's retirement planning services, where tailored strategies help Kiwis build and safeguard wealth for the long haul. Based in Mount Maunganui, New Zealand, this firm delivers bespoke advice grounded in international research and proven methods. They work nationwide, crafting plans that fit your unique situation, whether reviewing your KiwiSaver or setting up for retirement. What sets them apart is the focus on flexibility, giving access to advanced solutions like open-architecture investments for better diversification and specialised growth.

Clients appreciate the clear, partnership-style approach that turns complex ideas into simple steps. Imagine having a roadmap that projects your future cashflow and adjusts as needed, all while avoiding cookie-cutter funds. Their expertise shines in areas like UK pension transfers and Australian super transfers, making transitions seamless. Plus, options like the Global Growth Bitcoin Tilt add innovative edges for forward-thinking investors. With a commitment to clarity and better outcomes, Compound Wealth empowers you to retire with peace of mind.

Standout features: Personalised KiwiSaver reviews, advanced cashflow modelling, access to global diversification beyond standard funds, and specialist strategies for larger balances.

Facts and information: Founded in 2017, they partner with clients on high-quality investments, drawing from many positive reviews praising ease and recommendations; options like Compound Portfolios and Compound Pro enhance professional management; nationwide service builds confidence through ongoing support.

About Compound Wealth

Compound Wealth is a leading financial advisory firm based in Mount Maunganui, New Zealand. Founded in 2017 by Adam Stewart, we specialise in personalised KiwiSaver advice and investment planning for Kiwis nationwide.

Our mission: Deliver clarity, confidence, and better outcomes through bespoke strategies tailored to your life. We advise on over $130 million in assets, trusted by over 2,500 clients across the country.

Our Services

Discover expert financial solutions tailored for New Zealanders seeking optimised KiwiSaver advice, retirement planning, and private wealth management. As leading KiwiSaver advisors in Mount Maunganui, we help you maximise savings, transfer pensions, and build secure futures with personalised investment strategies.

KiwiSaver

KiwiSaver Advice NZ: Personalised guidance to enhance your KiwiSaver fund performance and retirement savings.

Global Growth + Bitcoin Tilt KiwiSaver Solution: Innovative KiwiSaver portfolios incorporating global investments and Bitcoin for diversified growth.

Compound Portfolios NZ: Custom-built investment portfolios designed for long-term wealth accumulation in New Zealand.

Bespoke KiwiSaver Plans: Tailored KiwiSaver strategies and premium plans for individual financial goals.

Australian Super Transfers to KiwiSaver: Seamless transfers of Australian superannuation to KiwiSaver for NZ residents.

Investments

Private Wealth Management NZ: Comprehensive services for high-net-worth individuals focusing on asset protection and growth.

Retirement Planning New Zealand: Expert retirement strategies including cashflow modelling and investment planning for a comfortable future.

UK Pension Transfer to NZ: Efficient transfers of UK pensions to New Zealand schemes with tax-efficient advice.

Investment Risk Assessment Quiz: Free online quiz to evaluate your risk tolerance and align investments accordingly.

Why Choose Us?

Personalised approach: No one-size-fits-all funds.

Advanced cashflow modelling for future insights.

Access to global diversification and specialist strategies.

Over 10 years of expertise in KiwiSaver and investments.

Direct support from knowledgeable advisors.

No call centres – just committed, ongoing guidance.

We use international research and proven methods to grow and protect your wealth effectively.

Ready to Take Control of Your Finances?

Book a free consultation with our experienced KiwiSaver and wealth advisors today.

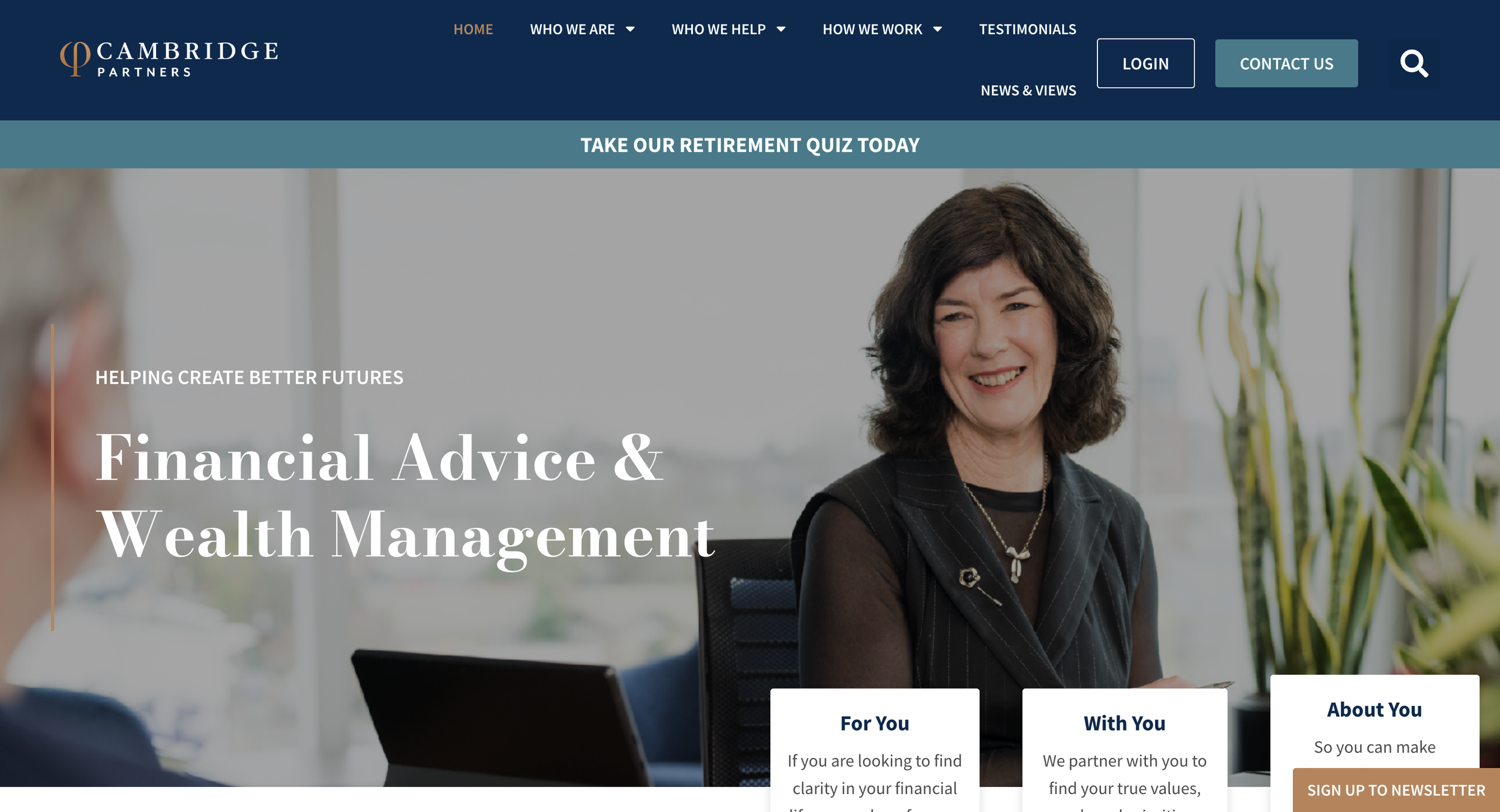

2. Cambridge Partners

Cambridge Partners provides financial advice and wealth management in New Zealand, with a strong focus on retirement investment planning to help clients reach their long-term goals. Based in Christchurch, the firm creates personalised plans by assessing your current situation, future objectives, and priorities. They manage wealth on an ongoing basis, making sure you can make efficient decisions and grab opportunities as they come. Their wealth management keeps an eye on your strategies, adjusting them as your goals or market conditions shift, with regular reviews to stay on course through life's ups and downs.

They use evidence-based solutions backed by over 70 years of academic research, and as a fee-only provider, they put your interests first. KiwiSaver optimisation is a big part of their retirement services, helping build a solid savings base. They also offer sustainable investing to match your values with your financial aims. For retirees or those nearing retirement, they have programmes to ensure a comfortable phase ahead. Strengths include a holistic, client-centred method with ongoing support and specialised help for groups like women in wealth or US expats. Weaknesses might involve the need for deep expertise in complex areas like international taxes, which could feel overwhelming for simpler needs.

Holistic planning integrating values and priorities, evidence-based investments, fee-only model, KiwiSaver optimisation, sustainable options, regular reviews.

Leading fee-only provider with FAP and DIMS licences; serves clients nationwide; focuses on life-stage support including retirement.

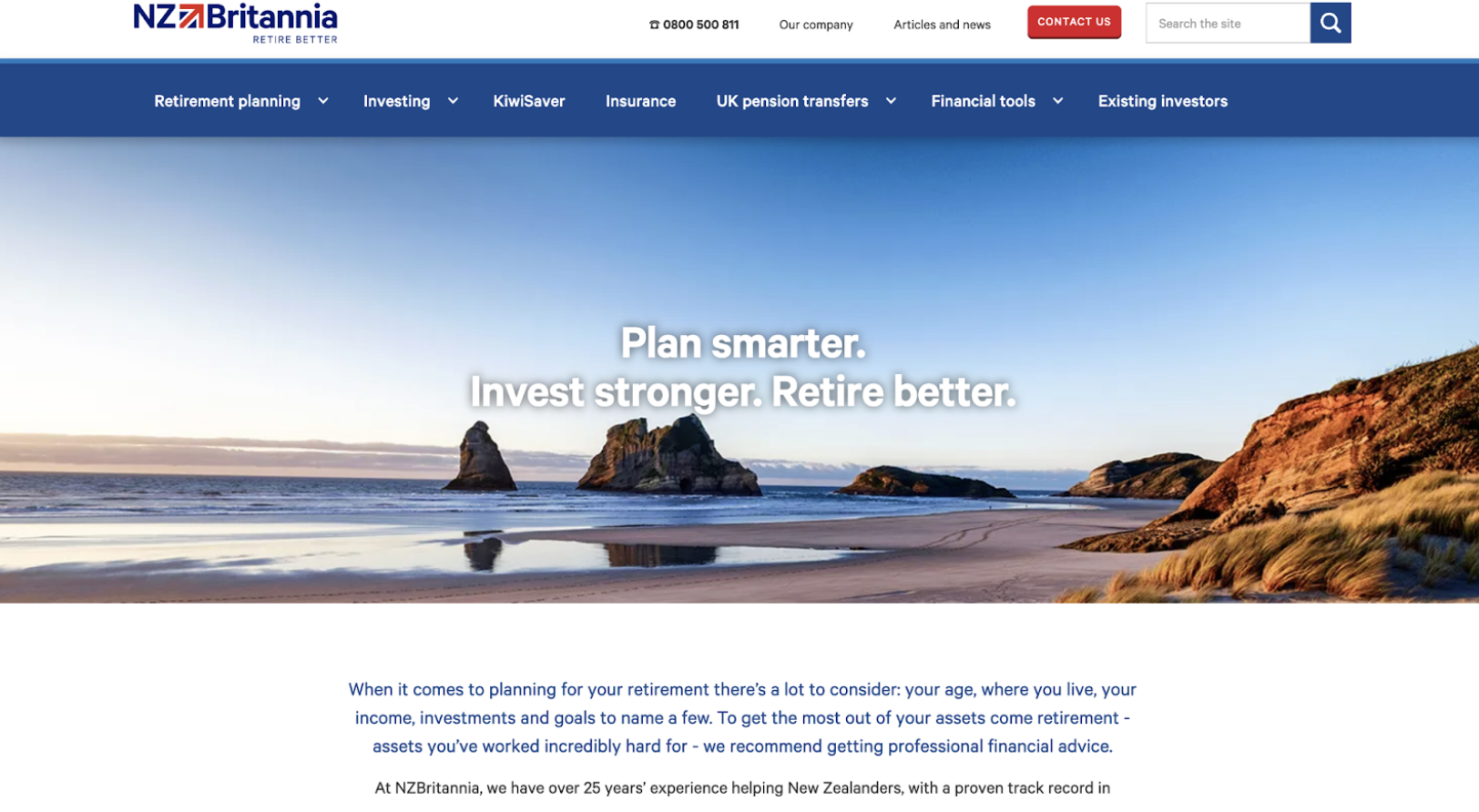

3. NZBritannia

NZBritannia delivers retirement planning and financial advice in New Zealand, drawing on over 25 years of experience to help people retire on their terms. They look at your age, where you live, income, investments, and goals to craft a plan that fits just right. This includes weaving in insurance, KiwiSaver, and estate planning to keep everything aligned. Their investment portfolios are custom-built using in-house products and ties with major providers, guiding you on the best KiwiSaver funds beyond the basics.

A key strength is their expertise in UK pension transfers, having handled moves from over 500 providers for more than 20,000 clients. They offer free assessments and tools like a retirement calculator to check if you're set. The approach is non-pushy, with specialist advisors giving clear, respectful guidance. Strengths lie in their long track record and specialist team, plus free resources that build confidence. Weaknesses could be a broader focus that might not dive as deep into purely local investments for some folks.

Tailored portfolios with insurance and estate integration, expert KiwiSaver advice, UK pension transfer specialists, retirement readiness tools like calculators.

Over 25 years serving Kiwis; facilitated thousands of pension transfers; positive client feedback on understanding and care.

4. Craigs Investment Partners

Craigs Investment Partners handles retirement wealth management in New Zealand, creating custom portfolios that adapt to your changing needs over time. With over 40 years in the game, they help protect your lifestyle in retirement by listening closely and blending global insights with local know-how. They manage UK pension transfers into personal portfolios for easy access and Australian super transfers to KiwiSaver, allowing withdrawals at 60 or in tough spots.

Their Craigs Superannuation Scheme gives flexible options tailored for retirement. Sustainable investing lets you align with your values. Nationwide advisors build lasting partnerships, often across generations. Strengths include a deep local presence and large-scale management, fostering trust through community ties. Weaknesses may stem from a preference for in-person meetings, which could be less convenient for fully remote clients.

Personalised KiwiSaver and superannuation management, international pension transfers, ongoing portfolio monitoring, sustainable investing choices.

Founded in 1984; over 20 locations across NZ; manages $30 billion for 65,000 clients; long-term family relationships.

5. Finsol

Finsol offers award-winning advice on KiwiSaver and investments in New Zealand, building strategies for wealth growth and security as you head toward retirement. They connect insurance, KiwiSaver, lending, and investments into one plan that matches your goals, whether you're just starting or close to retiring. KiwiSaver services pick funds and tactics based on your timeline, like saving for a home or later years.

Investment guidance helps everyday Kiwis grow wealth with clear steps, including property tips. Their financial reviews give a full picture to create a strong plan. No generic advice here; it's all tailored to real-life issues. Strengths are in their integrated, goal-focused approach with easy access via in-person or digital means. Weaknesses might include lighter details on specific retirement tools, making it feel less specialised at times.

Customised KiwiSaver matching, property investment guidance, comprehensive financial reviews linking multiple areas, international fund transfers.

Offices in Hawke’s Bay, Auckland, Taupo, Christchurch; nationwide digital consultations; client-centred without templates.

6. Moneyworks NZ Ltd

Moneyworks NZ Ltd guides clients toward and through retirement with ethical investments in New Zealand, cutting through greenwashing to make responsible choices. Based in Cambridge, they provide independent analysis and education on KiwiSaver, portfolios, and insurance, all aligned with your values. As Certified Ethical Financial Advisers, the team uses the same plans themselves, ensuring integrity.

They engage with managers like Booster for better stewardship. Services cover full financial advice, with core values like trust and empathy driving everything. Strengths include a strong ethical focus and community involvement, backed by client praise for reliable guidance. Weaknesses could be a narrower emphasis on ethics, which might limit options compared to wider providers.

Ethical certification, investment plans with goals and insurance, stewardship in fund picks, robotic tools for operations.

Licensed FSP supervised by FMA; team with personal ethical plans; resources on investing topics.

7. Lyfords

Lyfords provides financial guidance in New Zealand, crafting retirement income plans that consider your needs and potential subsidies. Based in Wellington, their six-step process builds roadmaps with tax-smart investments and KiwiSaver reviews. They use independent research to fit portfolios to your position and risk comfort.

Advisors monitor changes, offering remote options. They highlight longer life expectancies and stats on financial independence to stress preparation. Strengths are in structured, experienced advice with high qualifications and positive client feedback on professionalism. Weaknesses aren't clear, but fee awareness might be key for clients.

Six-step planning, independent research for portfolios, written advice, ongoing tracking and adaptations.

Over 60 years combined experience; Certified Financial Planners; supports remote and in-person.

8. DecisionMakers

DecisionMakers specialises in independent retirement plans and portfolio management in New Zealand, using risk profiling and research for custom fits. They work with your legal and tax pros for full plans, providing clear quarterly and annual reports. No commissions keep the focus on you, with advisors as owners for strong ties. They address family futures too. Strengths include unbiased advice, advanced tools, and long-term relationships shown in testimonials. Weaknesses may require more client involvement.

FinaMetrica risk system, consolidated reporting, ethical options, personalised no-commission plans.

Over 100 years team expertise; uses Morningstar research; blog insights on KiwiSaver and more.

9. G3 Financial Freedom

G3 Financial Freedom specialises in investment planning throughout New Zealand, delivering straightforward advice to expand and safeguard wealth as you approach retirement. Located in Tauranga, they craft comprehensive plans tailored to your specific objectives, offering unbiased perspectives on KiwiSaver schemes and pension arrangements. Their ongoing assistance adapts to fluctuating markets, prioritising financial independence. They excel in managing UK and Australian pension transfers efficiently, ensuring a smooth process. Services encompass financial planning basics, investment strategies, personal risk coverage, estate and asset organisation, budgeting and cashflow oversight, retirement preparation, and debt handling.

Advisors emphasise clarity and autonomy, avoiding complex jargon to make decisions accessible. They guide clients through life phases, from accumulating wealth to preserving it in retirement. The team provides fee-based, independent counsel, fostering lasting financial health. Clients benefit from personalised sessions that align with individual circumstances, such as family needs or career shifts. Strengths highlight simple, unbiased direction and all-encompassing services across various life stages, building trust through transparent communication. Weaknesses remain minimal, though some might seek more digital tools for tracking.

Tailored wealth protection, market adaptations, goal-oriented plans, pension transfer expertise.

Nationwide service from Tauranga; experienced advisors; holistic approach to goals.

10. Thrive Investment Partners

Thrive Investment Partners supports wealth creation centred on property in New Zealand, developing retirement strategies via new build investments. They identify verified properties, manage negotiations, and conduct yearly evaluations. Complimentary consultations ease entry, accompanied by calculators and resources. Focused on evidence-driven property investments, they aid Kiwis in constructing wealth with professional insights and market acumen. Their method involves strategic planning for retirement funding, outlining necessary income and pathways to achieve it. They stress avoiding sole reliance on savings, promoting property as a robust alternative for retirement income.

Advisors collaborate intimately to clarify goals, whether for leisure in later years or financial stability. Services include sourcing from extensive inventories, performing due diligence, and linking to specialists. They cater to novices and seasoned investors, ensuring investments match long-term aspirations like retirement. The comprehensive support stands out for beginners, offering clear routes to wealth accumulation. Strengths encompass regulated proficiency, complete assistance from start to finish, and strong client endorsements for transparent retirement trajectories. Weaknesses might arise from the concentrated emphasis on new properties, potentially restricting variety for those preferring diverse assets.

Property selection from large stocks, due diligence, specialist referrals, annual adjustments.

FMA-licensed for property; qualified advisors; 4.9-star reviews.

11. Lifetime

Lifetime delivers customised financial counsel in New Zealand, merging KiwiSaver, investments, and planning to ensure retirement stability. Their KiwiSaver initiatives form enduring tactics for home ownership or retirement, while investment options dynamically increase wealth. Financial planning correlates choices to ambitions like retirement enjoyment. They advocate early retirement preparation to evade financial worries later, granting liberty for preferred activities. Services span personal guidance, home financing, personal and general coverage, alongside retirement and financial scheming.

For retirement earnings, they transform savings into consistent, tax-managed fortnightly payments intended to endure lifelong. A dedicated retirement income division assists in securing steady revenue from savings or mortgage-free residences. They host webinars with specialists on retirement topics, enriching knowledge. The approach prioritises comprehension, confidence, and superior service, with elevated client contentment and lucid interaction. Strengths feature high satisfaction rates and effective dialogue, bolstered by principles such as integrity and openness. Weaknesses are not prominently specified, but may involve general constraints in specialised niches.

Personalised strategies, expert advisers, adaptability, goal connections.

98% client understanding; 4.7 rating; principles like integrity.

12. Rutherford Rede

Rutherford Rede supplies financial counsel in New Zealand for retirement, devoid of prejudices or commissions, concentrating on accountable investing to nurture enduring bonds. Headquartered in Auckland, they aid individuals, families, trusts, foundations, and charities with a privately owned advisory setup. Their holistic strategy to financial planning quantifies retirement requirements, transcending mere numerical targets to grasp personal aims, lifestyle desires, and prospective costs. They assist in devising long-term tactical plans for retirees, erecting and overseeing investment portfolios.

The process entails pinpointing, examining, and strategically plotting for personal goal attainment. Whether pursuing strategic blueprints, financial recommendations, investment oversight, or reviews of current strategies, they adhere to a uniform methodology. Emphasis on responsible investing incorporates sustainable scrutiny. With over a century of collective expertise, they sustain stable teams for consistent service. Strengths comprise independence, ethical standards, and long-haul focus, cultivating trust via exceptional care. Weaknesses are not elaborated beyond standard provisions, possibly indicating a need for more varied digital engagements.

Long-term focus, over 100 years experience, sustainable due diligence.

Partner-owned; 30+ years in business; stable teams.

13. AdviceFirst

AdviceFirst furnishes personalised counsel in New Zealand for retirement through insurance, wealth, and KiwiSaver, with salary-compensated advisors placing client necessities foremost. They empower financial futures with adapted advice, proficiency in wealth administration, coverage, and KiwiSaver. As a licensed financial advice entity, they serve New Zealanders nationwide. KiwiSaver guidance readies for retirement and occasionally first-home aims, presenting a beneficial investment for qualified individuals.

They underscore safeguarding retirement by anticipating unforeseen events, crafting contingencies alongside ideal lifestyle plans. Services promote transparency and results, aiding in protecting assets and optimising savings. Advisors prioritise client interests without commission influences, ensuring impartial recommendations. With over a decade of operation, they maintain a national footprint for accessible support. Strengths reside in openness, outcome-oriented methods, and non-commission structures that build credibility. Weaknesses are absent from statements, suggesting robustness in core offerings.

Non-commission advice, customised investments, KiwiSaver optimisation.

Nationwide; over a decade experience; client support.

14. Booster

Booster bolsters retirement savings in New Zealand via KiwiSaver, investments, and UK transfers, featuring ethical funds that resonate with values and app-based monitoring. As a New Zealand-owned financial services firm in Wellington, they've tended to Kiwis' finances since 1998. Their app serves as a central financial point, tracking KiwiSaver, managing investments, and handling expenditures and savings. Products include superannuation, financial counsel, and budgeting aids. The Booster SuperScheme facilitates retirement savings with flexibility in New Zealand and UK currencies.

They provide money wisdom for informed choices amid uncertainties. Ethical alternatives and diverse funds cater to varied preferences. Advisors offer guidance on navigating financial paths, emphasising community and trust. The integrated platform enhances user experience, allowing real-time insights into contributions and performance. Strengths lie in reliability, community orientation, and award acknowledgements, supported by extensive membership. Weaknesses are not specified, but may pertain to broader market dependencies.

Variety of funds, ethical options, app management, advice for uncertainties.

Over 200,000 members; 25+ years; awards recognition.

15. Milford Asset Management

Milford Asset Management concentrates on KiwiSaver for retirement in New Zealand, targeting robust returns with digital instruments for oversight. As award-winning investment authorities, they collaborate with clients to realise financial objectives. Offerings encompass KiwiSaver, investment funds, private equity, wealth management, and advice. Funds present varied strategies with distinct risk-return profiles and fees. Wealth management delivers understanding, trust, and outstanding service for goal achievement.

They manage substantial assets, serving numerous clients with multiple accolades. Active investing and goal monitoring facilitate easy fund transitions. The team employs expert insights to optimise portfolios, adapting to market dynamics. Services suit individuals seeking growth toward retirement, with tools for performance tracking. Strengths include recognitions and vast management scale, ensuring professional handling. Weaknesses primarily relate to the KiwiSaver focus, potentially limiting for those desiring more comprehensive planning beyond investments.

Active investing, goal tracking, easy switches.

$30 billion managed; 200,000 clients; multiple awards.

Current Trends Shaping Retirement Investments in New Zealand

Shifts in global markets influence how Kiwis approach savings. Many lean toward diversified portfolios mixing local and international assets for balance. Sustainable choices gain traction, letting values guide picks without sacrificing growth. Tech tools, like online quizzes, make assessing risks quicker. Private wealth management rises for those with complex needs, offering deeper customisation.

How to Begin Your Retirement Planning Journey

Start by reviewing your current setup, including superannuation and debts. Set clear goals, like travel or family support, to shape your path. Chat with advisors for fresh perspectives on options. Use free resources to learn basics before diving in. Regular check-ins keep things aligned as situations change.

FAQ

What makes a good retirement investment planning service in New Zealand?

Effective services blend deep understanding of local financial rules with strategies that grow savings over time. They emphasise clear communication to break down options like diversified portfolios and tax considerations. Tailored approaches, such as those in retirement planning, ensure your unique circumstances guide every decision for lasting security.

How does KiwiSaver play into retirement planning?

The KiwiSaver scheme serves as a foundational tool by allowing contributions from you, your employer, and the government to accumulate funds efficiently. It offers various fund types to suit different timelines, from conservative to growth-oriented. Integrating KiwiSaver with broader investments, including innovative choices helps create a robust base for future needs.

What should I know about international pension transfers for NZ retirement?

Moving funds from overseas schemes involves assessing eligibility under New Zealand regulations to access savings sooner. Key aspects include evaluating exchange rates and potential tax effects during the process. Services handling UK pension transfers or Australian super transfers streamline consolidation into local options for easier management.

Why include risk assessment in your retirement plan?

Evaluating your tolerance for market variations helps select investments that align with your comfort level and objectives. This process reveals preferences through structured tools, leading to balanced strategies that minimise unease. Taking a risk assessment quiz refines choices, supporting steady progress while adapting to personal changes.

Discover the Best Retirement Investment Planning Services in New Zealand - Compound Wealth