2025 Year-to-Date Market Returns: A Reminder of Why Diversification Matters

As we move through 2025, markets have delivered a wide dispersion of returns across asset classes. Some traditionally defensive assets have led the way, while areas that performed exceptionally well in recent years have lagged.

This is exactly how markets tend to behave over shorter time frames — unpredictably.

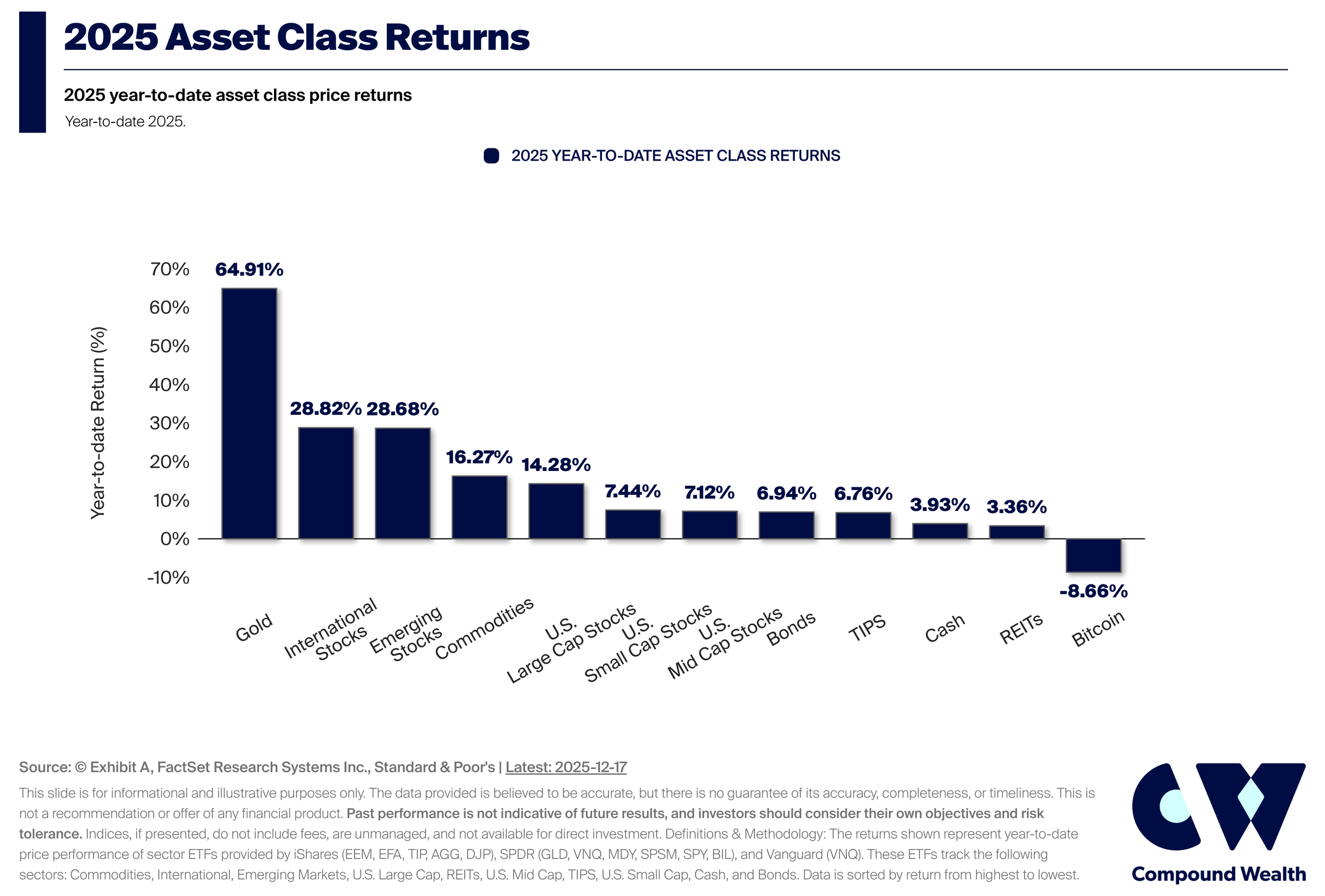

Below is a snapshot of year-to-date asset class returns for 2025 (to mid-December), which provides a useful lens on what has driven performance so far this year.

2025 Year-to-Date Asset Class Returns

Gold: +64.9%

International Shares (Developed ex-US): +28.8%

Emerging Market Shares: +28.7%

Commodities: +16.3%

US Large-Cap Shares: +14.3%

US Small-Cap Shares: +7.4%

US Mid-Cap Shares: +7.1%

Bonds: +6.9%

Inflation-Linked Bonds (TIPS): +6.8%

Cash: +3.9%

REITs (Property): +3.4%

Bitcoin: -8.7%

(Source: FactSet / S&P, data as at 17 December 2025)

What Has Driven Markets in 2025?

Gold Has Been the Standout

Gold has been the clear outperformer in 2025. Persistent inflation concerns, geopolitical uncertainty, and continued central bank demand have reinforced gold’s role as a defensive store of value. Periods like this highlight why gold can play a stabilising role in diversified portfolios, even though it often underperforms in strong equity bull markets.

International and Emerging Markets Have Surprised on the Upside

International and emerging market equities have materially outperformed US shares this year. A combination of more attractive starting valuations, improving economic conditions in parts of Asia, and a moderation in US equity leadership has driven this rotation. This is a good reminder that global diversification matters — leadership changes over time.

US Shares Have Delivered Solid but Unspectacular Returns

US large-cap equities have produced respectable gains, though well below the outsized returns seen in recent years. This reflects a more normal environment of slower earnings growth, tighter financial conditions, and less concentration in a handful of mega-cap stocks.

Defensive Assets Have Done Their Job

Bonds, inflation-linked securities, and cash have not generated headline-grabbing returns, but they have provided stability. In a year where volatility has picked up in growth assets, these allocations have helped dampen portfolio swings rather than drive returns.

Bitcoin: A Volatile Year

Bitcoin has experienced a meaningful drawdown year-to-date after a very strong prior run. This highlights the reality of high-volatility assets — periods of strong upside are often followed by sharp corrections. Position sizing, time horizon, and behavioural discipline are critical when allocating to assets like this.

The Bigger Picture: Why This Matters

2025 has been a textbook example of why no single asset class leads every year.

Chasing last year’s winners rarely ends well. Instead, well-constructed portfolios are built to:

Participate in growth when markets are rising

Remain resilient when leadership changes

Avoid reliance on any one outcome or asset

Diversification is not about maximising returns in any one year. It is about managing risk and improving the probability of achieving long-term goals.

Looking Ahead

Markets will continue to rotate. Asset classes that have led in 2025 may underperform in 2026, and laggards may rebound. The future path will be shaped by inflation trends, interest rates, geopolitics, and economic growth — none of which are reliably predictable.

This is why at Compound Wealth we focus on long-term strategy, disciplined portfolio construction, and staying invested, rather than reacting to short-term noise.

If you would like to sense-check whether your current investment or KiwiSaver portfolio is positioned appropriately for your goals and time horizon, we are always happy to help.

Past performance is not indicative of future results. Returns shown are illustrative and do not reflect individual investor outcomes.