Best Retirement Planners in NZ in 2026

Planning your retirement in New Zealand calls for solid guidance from experienced advisers. Whether you're building wealth through KiwiSaver or managing investments, the right planner helps you map out a path that suits your lifestyle and goals. Discover the best retirement planners in NZ in 2026 to secure your financial future.

Many Kiwis turn to professionals for advice on diversification and risk management to make sure their savings last. Retirement advisers or financial planners offer tailored support. For those seeking expert help, retirement planning stands out as a key service. This approach focuses on your unique situation, from early savings to post-retirement income.

Discover the Best Retirement Planners in NZ in 2026 - Compound Wealth

What Makes a Good Retirement Planner

A strong retirement planner listens to your goals and builds a custom plan around them. They assess your current savings, income sources, and risk tolerance to create strategies that grow your wealth over time. In NZ, advisers often incorporate KiwiSaver schemes and investment options to boost returns. They also factor in life changes, like health or family needs, to keep your plan flexible.

Some planners use tools like quizzes to gauge your comfort with market ups and downs. For instance, a risk assessment quiz can reveal if conservative or growth-focused options suit you better. Many successful planners hold certifications and stay updated on regulations from bodies like the Financial Markets Authority.

Good planners provide ongoing support, reviewing your progress yearly. They help with transfers from overseas pensions to integrate everything smoothly. This ensures your retirement funds work harder without unnecessary fees or gaps.

How Retirement Planning Differs in NZ

In New Zealand, retirement planning centres on a mix of government support and personal savings. NZ Super provides a base income from age 65, but many rely on additional sources like KiwiSaver or private investments to maintain their lifestyle. Advisers help bridge this gap by recommending diversified portfolios that include shares, bonds, and property. Unlike some countries, NZ lacks mandatory employer contributions beyond KiwiSaver, so personal initiative matters more.

Planners often guide on Australian super transfers for those with funds across the Tasman. They also advise on tax-efficient ways to draw down savings. Some focus on ethical investments or global exposure to hedge against local market shifts.

Best Retirement Planners in NZ in 2026

1. Compound Wealth - Best Retirement Planner

Compound Wealth delivers standout retirement planning with a focus on independence and custom strategies. Based in Mount Maunganui, this firm helps Kiwis nationwide build secure futures through smart KiwiSaver choices and investment management. Their approach starts with understanding your goals, then crafting plans that blend diversification and growth. Clients benefit from open-architecture solutions, giving access to a wide range of funds without ties to specific providers. This flexibility allows for tailored portfolios that match your risk level and timeline.

Whether you're in your 40s saving for later years or nearing 65 and adjusting income streams, their advisers provide clear steps. They incorporate advanced tactics for those seeking higher potential returns in a controlled way. Standout features include detailed cashflow modelling to project your financial path decades ahead. This helps spot opportunities early and adjust for changes. Their team draws on deep market knowledge to select high-quality managers, ensuring your money grows steadily. For KiwiSaver enthusiasts, options like global growth funds add an edge. Overall, Compound Wealth shines in making complex decisions feel straightforward and empowering.

Key features: Custom KiwiSaver schemes such as global growth bitcoin tilt KiwiSaver, diversified compound portfolios, and premium advice via compound pro.

Facts and information: Focuses on long-term horizons of 10-30 years, serving clients across NZ with virtual and in-person meetings. Emphasises unbiased comparisons of market options for better outcomes.

About Compound Wealth

Compound Wealth is a leading financial advisory firm based in Mount Maunganui, New Zealand. Founded in 2017 by Adam, we specialise in personalised KiwiSaver advice and investment planning for Kiwis nationwide.

Our mission: Deliver clarity, confidence, and better outcomes through bespoke strategies tailored to your life. We advise on over $130 million in assets, trusted by over 2,500 clients across the country.

Our Services

Discover expert financial solutions tailored for New Zealanders seeking optimised KiwiSaver advice, retirement planning, and private wealth management. As leading KiwiSaver advisers in Mount Maunganui, we help you maximise savings, transfer pensions, and build secure futures with personalised investment strategies.

KiwiSaver

KiwiSaver Advice NZ: Personalised guidance to enhance your KiwiSaver fund performance and retirement savings.

Global Growth + Bitcoin Tilt KiwiSaver Solution: Innovative KiwiSaver portfolios incorporating global investments and Bitcoin for diversified growth.

Compound Portfolios NZ: Custom-built investment portfolios designed for long-term wealth accumulation in New Zealand.

Bespoke KiwiSaver Plans: Tailored KiwiSaver strategies and premium plans for individual financial goals.

Australian Super Transfers to KiwiSaver: Seamless transfers of Australian superannuation to KiwiSaver for NZ residents.

Investments

Private Wealth Management NZ: Comprehensive services for high-net-worth individuals focusing on asset protection and growth.

Retirement Planning New Zealand: Expert retirement strategies including cash flow modelling and investment planning for a comfortable future.

UK Pension Transfer to NZ: Efficient transfers of UK pensions to New Zealand schemes with tax-efficient advice.

Investment Risk Assessment Quiz: Free online quiz to evaluate your risk tolerance and align investments accordingly.

Why Choose Us?

Personalised approach: No one-size-fits-all funds.

Advanced cash flow modelling for future insights.

Access to global diversification and specialist strategies.

Over 10 years of expertise in KiwiSaver and investments.

Direct support from knowledgeable advisers

No call centres – just committed, ongoing guidance.

We use international research and proven methods to grow and protect your wealth effectively.

Ready to Take Control of Your Finances?

Discover how Compound Wealth can shape your retirement with expert guidance.

2. Cambridge Partners

Cambridge Partners, headquartered in Christchurch, offers comprehensive retirement planning with a holistic view of your finances. They consider everything from current investments to property holdings, aiming to simplify your setup as you approach retirement. Their advisers build long-term plans that adapt to life stages, focusing on sustainable income without overcomplicating things. Strengths include strong expertise in KiwiSaver integration and ethical investment choices, which appeal to many clients. However, their services might feel more structured, potentially less flexible for those wanting quick changes.

The firm has a solid track record in helping families align plans with personal values. Clients often praise the team's decades of experience in navigating retirement transitions smoothly. By incorporating tools like cashflow projections, they help visualise post-work life, ensuring you have enough to enjoy hobbies or travel. Their approach emphasises understanding your unique situation, from health needs to family dynamics, to craft a resilient strategy. This makes them a reliable choice for those seeking clarity in complex financial landscapes. Overall, Cambridge Partners excels in providing peace of mind through thoughtful, value-based planning.

Key features: Portfolio management, KiwiSaver advice, and retirement withdrawal strategies.

Facts and information: Operates nationwide, with a team experienced in managing nest eggs for pre- and post-retirees.

3. Bradley Nuttall

Bradley Nuttall, located in Christchurch and Nelson, specialises in investment and retirement advice tailored to individual needs. They guide clients through financial planning processes that cover wealth protection and growth. Advisers here emphasise evidence-based investing, which helps in creating confident retirement paths. A key strength is their focus on family security, but some might find the process thorough to a fault, requiring more initial input. The firm supports clients at various life stages, from building savings to drawing them down.

With a commitment to clarity and long-term security, they use detailed assessments to identify risks and opportunities. This includes integrating KiwiSaver with other assets for balanced outcomes. Clients benefit from regular reviews that adjust for market shifts or personal changes, like health events. Their team brings deep knowledge, making complex concepts accessible. By prioritising client education, they empower better decisions. This holistic method suits those who value structured guidance over quick fixes. Bradley Nuttall stands out for fostering financial confidence through proven strategies.

Key features: KiwiSaver optimisation, financial projections, and estate planning elements.

Facts and information: Known for certified advisers who prioritise long-term security over short-term gains.

4. Milford Asset Management

Milford Asset Management, based in Auckland, provides retirement planning through a range of investment services and resources. They help clients calculate retirement needs and manage funds accordingly. Their approach includes active management of portfolios, which can lead to better performance in volatile markets. Strengths lie in their educational tools and fund options, though the firm is larger, which might mean less personalised attention for some. They cater to those with substantial savings looking for professional oversight.

Resources like videos explain KiwiSaver usage in retirement, aiding informed choices. Advisers focus on diversification across assets to mitigate risks. This suits clients interested in global exposure or ethical funds. By offering calculators, they help project future income, factoring in inflation and lifestyle goals. Milford's team stays ahead of market trends, providing timely advice. While their scale brings robust research, it could feel impersonal for those preferring boutique service. Still, their commitment to client education makes retirement planning more approachable.

Key features: Diversified funds, retirement calculators, and wealth management for higher-net-worth individuals.

Facts and information: Offers videos and guides on KiwiSaver usage in retirement, serving clients across NZ.

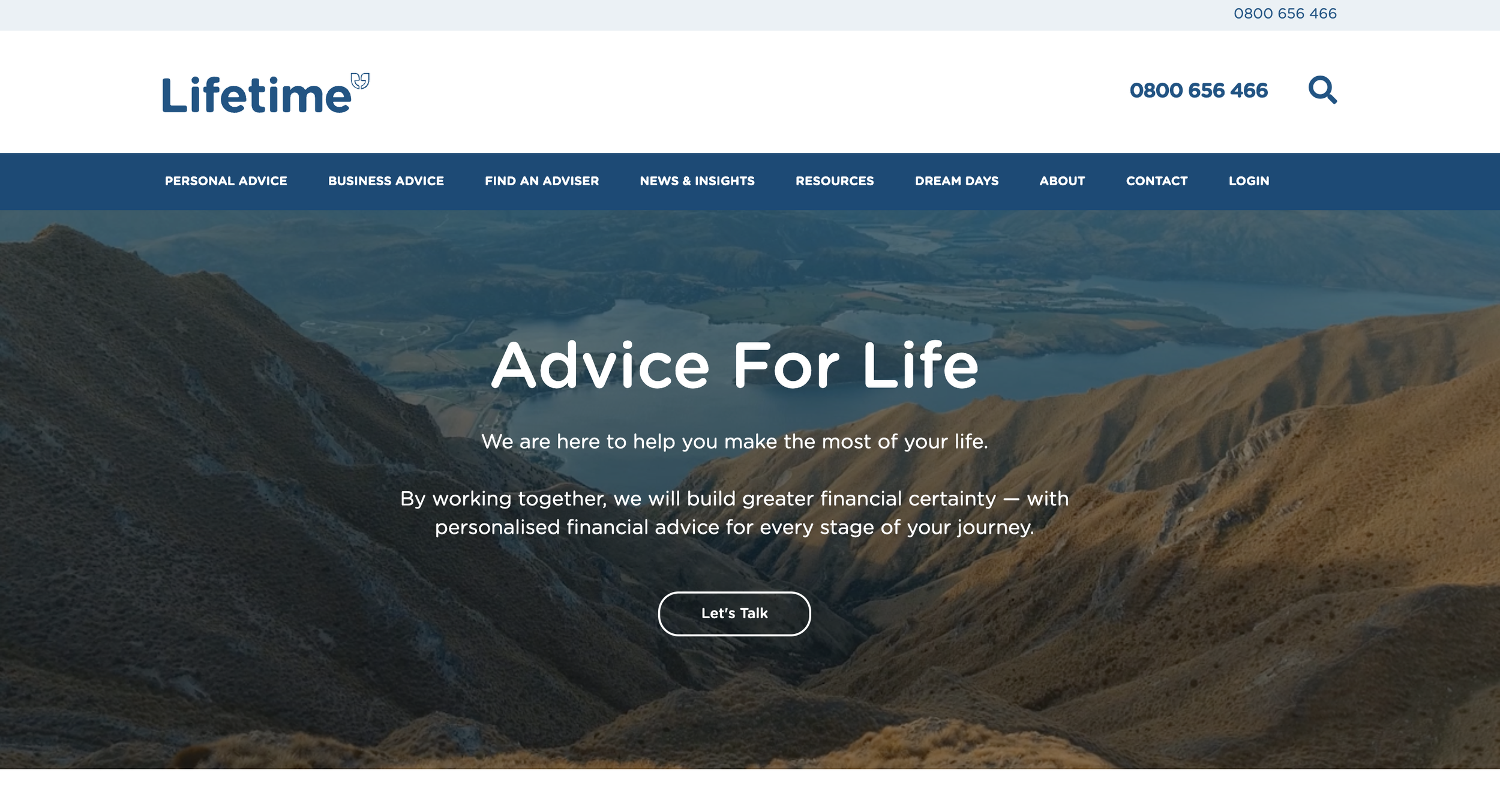

5. Lifetime

Lifetime, with offices around NZ, focuses on financial planning that evolves with your life. They design investment plans and KiwiSaver strategies to support retirement goals. Advisers here stress clarity in connecting daily decisions to future outcomes. A strength is their adaptability to changing circumstances, but the breadth of services could overwhelm those seeking simplicity. The firm helps from early career stages to retirement transitions.

By creating tailored roadmaps, they address gaps in savings or risk exposure. This includes shifting funds as you age for preservation. Clients appreciate the ongoing adjustments that keep plans relevant. Lifetime's approach integrates insurance and estate elements for comprehensive security. Their nationwide presence ensures accessibility. While versatile, the wide scope might dilute focus for specialised needs. Nonetheless, they excel in making planning feel dynamic and supportive.

Key features: Tailored investment strategies, KiwiSaver reviews, and ongoing plan adjustments.

Facts and information: Emphasises personalised advice for different life phases, including retirement preparation.

6. Rede Advisers

Rede Advisers, in Christchurch, has provided financial planning since 2003, with a strong emphasis on retirement. They offer independent advice to prepare for a deserving future. Strengths include clear, unbiased guidance, but their regional focus might limit options for nationwide clients. The firm works to make retirement feel achievable through structured plans. Advisers assess current assets and goals to build sustainable strategies.

This involves KiwiSaver optimisation and investment diversification. Clients benefit from straightforward explanations that demystify finances. By focusing on long-term horizons, they help avoid common pitfalls like under-saving. Their independence ensures recommendations align solely with client interests. While locally strong, expansion could enhance reach. Rede shines in delivering reliable, no-nonsense advice for secure retirements.

Key features: Investment management, risk assessments, and long-term forecasting.

Facts and information: Serves clients seeking straightforward paths to financial freedom.

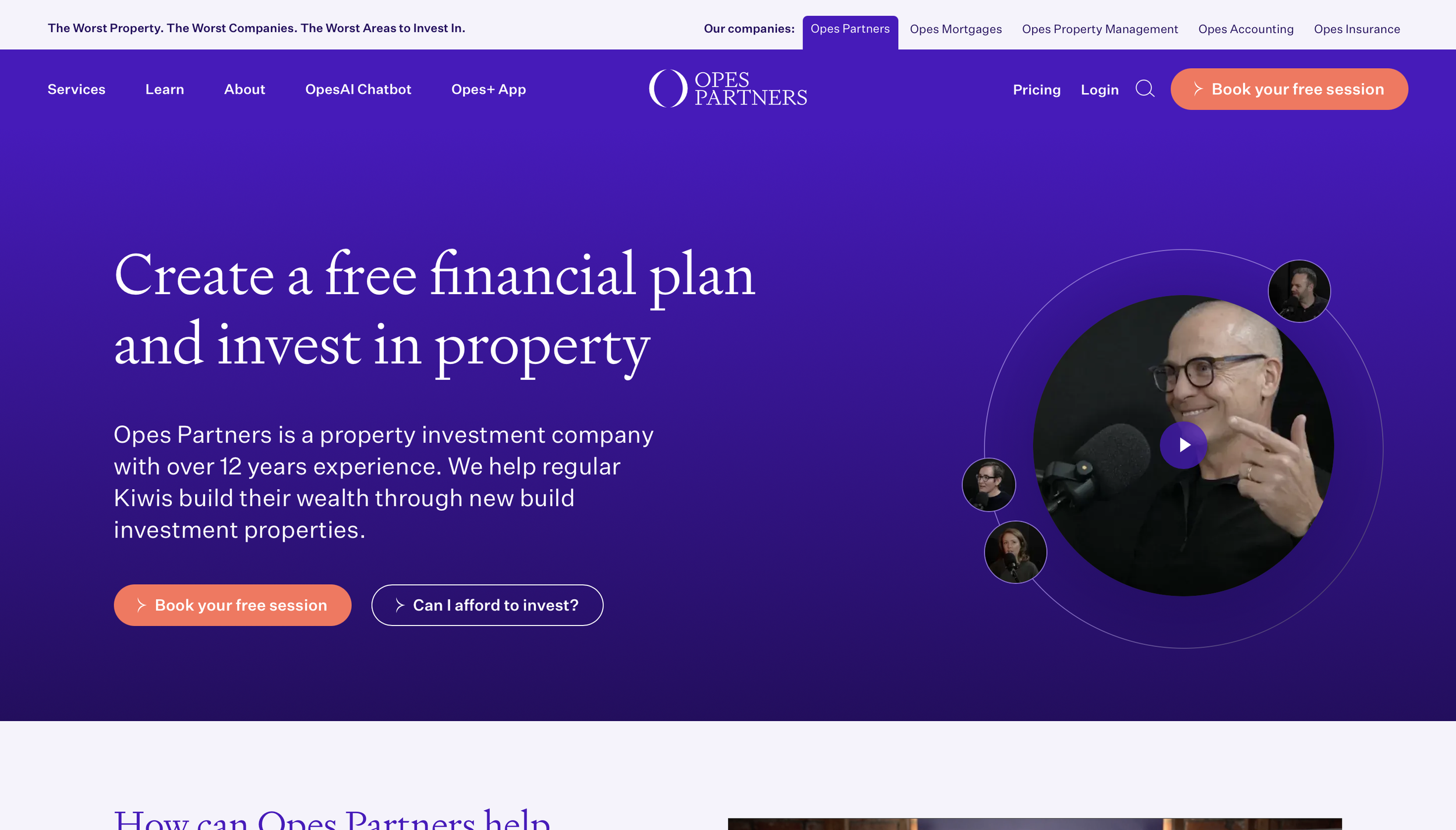

7. Opes Partners

Opes Partners specialises in property-related advice but extends to retirement nest eggs. Based in NZ, they help with investments and budgeting for long-term security. A strength is their property expertise, useful for diversified retirements, though it might not suit pure investment-focused individuals. They provide guides and plans for financial freedom.

Advisers craft wealth plans that incorporate real estate for passive income in retirement. This complements KiwiSaver for balanced portfolios. Clients often start as first-home buyers and evolve to retirees. By emphasising goal achievement, they map steps to financial independence. Their resources educate on market trends, aiding informed decisions. While property-centric, this adds unique value for some. Opes supports transitions to retirement with practical strategies.

Key features: Wealth plans, property investment integration, and retirement strategies.

Facts and information: Assists from first-home buyers to retirees, with a focus on goal achievement.

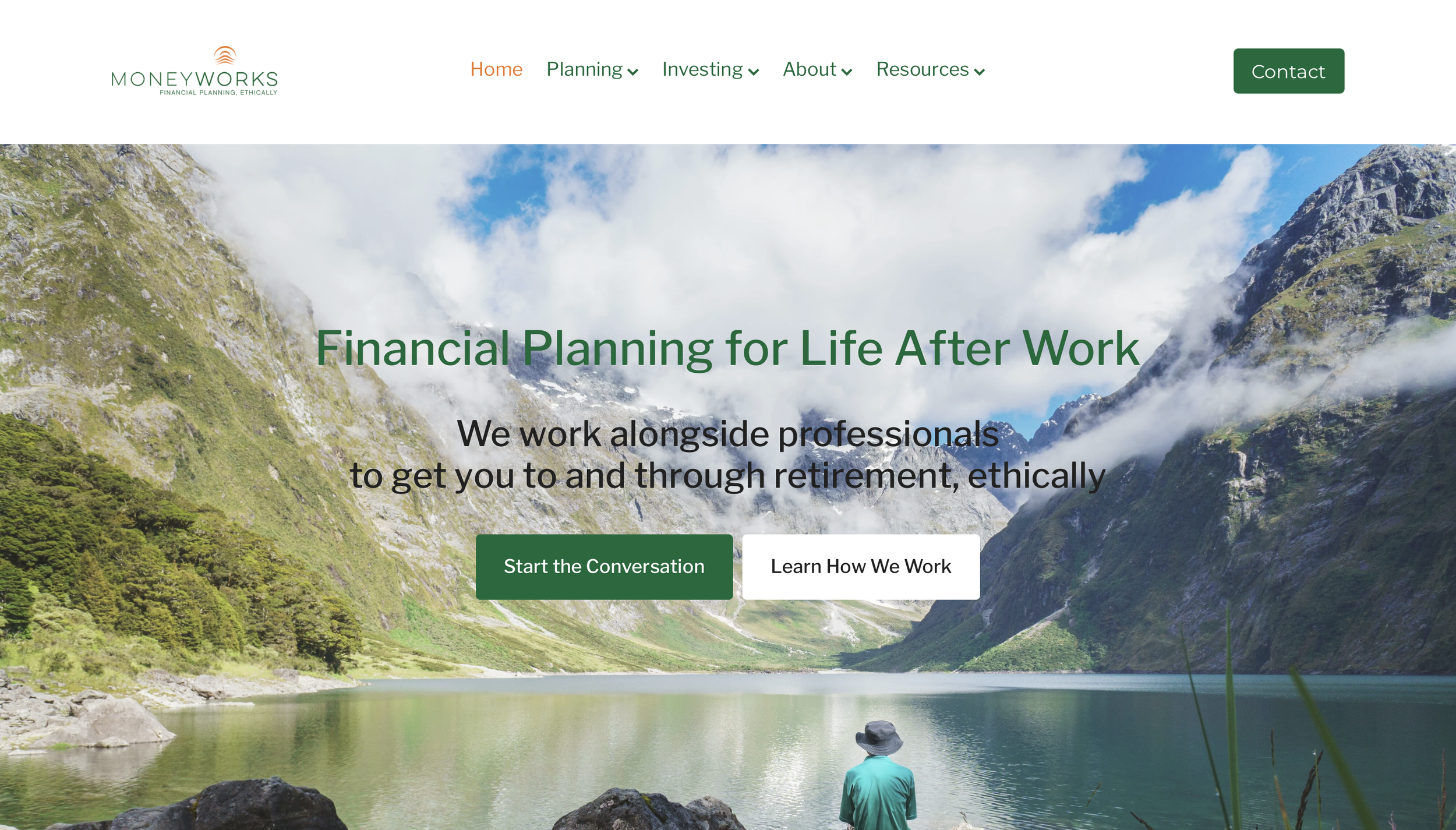

8. Moneyworks

Moneyworks, operating in NZ, targets professionals nearing or in retirement with ethical financial planning. They structure investments for income and flexibility. Strengths include a grounded approach to ethics, but the niche focus on analytical clients could exclude others. The team supports long-term relationships.

Advisers bring together strategy and ongoing advice in clear ways. This suits scientists, doctors, and similar thinkers valuing evidence. By prioritising ethical investments, they align with client values. Retirement plans emphasise peace of mind through sustainable income. Their small team fosters close support. While specialised, this depth benefits matching clients.

Key features: Investment strategy, retirement income planning, and ethical options.

Facts and information: Works with couples and professionals for peace-of-mind retirements.

9. Craigs Investment Partners

Craigs Investment Partners, established in 1984, offers retirement advice through investment management. Based in NZ, they provide access to markets and planning tools. A strength is their staff ownership model, fostering dedication, but the scale might dilute personal touch. They help with diversification and growth.

Advisers work on portfolio construction for retirement security. This includes market insights for informed choices. Clients range from beginners to seasoned investors. By being Kiwi-grown, they understand local needs. Their nationwide offices ensure convenience. While large, this brings robust resources.

Key features: Portfolio construction, market access, and retirement projections.

Facts and information: Focuses on trusted, long-standing service for wealth building.

10. Forsyth Barr

Forsyth Barr, staff-owned for over 85 years, delivers independent retirement planning across NZ. They emphasise financial advice that protects and grows savings. Strengths include deep market insights, though some find the traditional style less innovative. The firm supports comprehensive planning. Advisers integrate KiwiSaver and risk management for solid retirements. This suits those valuing stability. Their long history builds trust. By focusing on independence, they avoid biases. Clients get tailored strategies for life stages.

Key features: Investment advice, KiwiSaver integration, and risk management.

Facts and information: Serves clients with a commitment to independence and expertise.

11. Rutherford Rede

Rutherford Rede, a privately held firm in New Zealand, serves individuals, families, trusts, and charities with over 30 years of experience. They emphasise retirement planning within comprehensive advice, focusing on long-term strategies and sustainable investing. Strengths include partner ownership for unbiased, commission-free guidance, and a team with over 100 years combined expertise.

However, the emphasis on technical depth might feel intensive for casual clients. Advisers prioritise emotional intelligence alongside business acumen for stable relationships. Their approach starts with conversations to simplify finances and enhance affairs. By integrating responsible principles, they ensure plans align with values. This makes them ideal for those seeking enduring support. Client retention remains high due to consistent advisers.

Key features: Sustainable investing, due diligence processes, and collaborative team support.

Facts and information: Focuses on people and entities at all life stages, with a client-centric culture.

12. Become Wealth

Become Wealth, headquartered in Auckland with presence in Christchurch, helps Kiwis build and maintain wealth through tailored plans. They offer financial planning, investments, KiwiSaver, and more, with a focus on retirement via savings optimisation. Strengths include aligned client interests, approachable teams, and comprehensive services in one place. Though broad, this might spread focus thin for highly specialised needs. Advisers collaborate to create non-template strategies for goals like passive income. Tools like retirement calculators aid projections. High reviews praise clear communication and stress-free processes. Their methodology draws on proven wealth-building steps.

Key features: Property investment guidance, life insurance, and free consultations.

Facts and information: Targets all ages, trusted by government and listed companies for confident futures.

13. G3 Financial Freedom

G3 Financial Freedom, based in Tauranga, provides independent, fee-based advice nationwide. They specialise in retirement planning with tailored strategies, ongoing support, and pension expertise. Strengths lie in jargon-free guidance and holistic goal alignment, but the regional base might require virtual meetings for distant clients. Services include investment portfolios and transfers for UK or Australian funds. Advisers focus on financial wellbeing at every stage, from wealth growth to life changes.

Key features: Pension transfers, regular check-ins, and personalised roadmaps.

Facts and information: Emphasises independent solutions for secure, fulfilling retirements.

14. Smart Adviser

Smart Adviser, based in Auckland, empowers Kiwis with independent financial planning and advice. They focus on retirement preparation to secure future lifestyles, integrated into holistic services. Strengths include unbiased guidance and personalised plans, though the comprehensive process might demand client involvement. Their 6-step method builds foundations like debt management and investments. Award-winning team handles KiwiSaver, insurances, and more.

Key features: Mortgage services, business protection, and legacy building.

Facts and information: Serves individuals, families, and owners for financial control.

15. Velocity Financial

Velocity Financial, operating in New Zealand with a Wellington focus, specialises in mortgages, insurance, and KiwiSaver for security. They emphasise retirement through maximised KiwiSaver plans. Strengths include accessible consultations and proactive tools, but the multi-service model might not delve as deep into pure planning. Resources like blogs aid insights. They support first buyers to investors.

Key features: Parametric insurance, employee benefits, and property financing.

Facts and information: Targets all life stages for health and financial peace.

Benefits of Starting Retirement Planning Early

Beginning your retirement preparations sooner gives you more time to build savings through compounding. In NZ, early involvement with advisers can spot gaps in your KiwiSaver or investments, allowing adjustments that add security later. Many find that starting in their 30s or 40s leads to more options, like private wealth management for higher growth. This timing also helps manage risks from market changes or unexpected events.

Role of KiwiSaver in Your Retirement Strategy

KiwiSaver plays a central part in NZ retirements by offering government and employer boosts to your savings. Advisers often recommend reviewing your fund type to match your age and risk level, shifting from growth to conservative as retirement nears. Some schemes include unique tilts for added potential, enhancing overall returns. This program complements NZ Super, filling income gaps for a comfortable lifestyle. Integrating it with other investments creates a balanced approach.

Common Pitfalls in Retirement Planning

One frequent mistake is underestimating healthcare costs in later years, which can drain savings quickly.

Many overlook inflation's impact, assuming current expenses will stay the same.

Advisers suggest regular reviews to account for these.

Another issue is ignoring tax implications on withdrawals, leading to surprises.

Diversifying too little exposes you to market dips, while over-diversifying can dilute gains.

Procrastinating on advice often means missed opportunities for growth.

FAQ

What should I consider when choosing a retirement planner in NZ?

Advisers who understand your personal goals make a big difference in crafting plans that fit your life. Independence matters because it leads to recommendations based on your needs rather than product sales. Clear explanations and consistent check-ins build trust over time. Certifications from groups like Financial Advice New Zealand add a layer of reliability.

How does KiwiSaver fit into retirement planning?

KiwiSaver acts as a core tool for growing savings through regular contributions that compound over years. Advisers guide fund selections to match your stage, shifting focus as you get closer to drawing income. It pairs well with other holdings to create a reliable stream for daily living. Innovative choices can add variety for those open to new approaches.

Can I transfer overseas pensions to NZ for retirement?

Bringing in funds from abroad, such as through UK pension transfer or Australian super transfers, streamlines your overall setup. Advisers manage the details to meet local requirements and avoid complications. This move combines everything into one system for easier oversight. Acting ahead gives more time to handle any paperwork smoothly.

When is the best time to start retirement planning?

Getting underway early, such as in your working prime, sets up stronger foundations through gradual building. Advisers use tools like projections to highlight paths forward. Adjustments become simpler with more years ahead. Even later starts can still shape positive outcomes with focused efforts.

Why is risk assessment important in retirement planning?

Evaluating your comfort with fluctuations helps tailor investments that avoid undue stress. Tools like a risk assessment quiz reveal preferences for steady or bolder options. This step ensures your plan balances protection and potential gains. Regular checks keep it relevant as circumstances evolve.

Read Also:

Discover the Best Retirement Planners in NZ in 2026 - Compound Wealth