Best Wealth Management Firms in 2026

Finding the right firm to handle your finances can feel overwhelming in a fast-changing world. With rising needs for tailored advice and secure growth, the best wealth management firms stand out by offering clear plans that fit individual lives. Discover the best wealth management firms in 2026 for growing and protecting your assets.

These companies help with everything from daily investments to long-term retirement setups. Whether you're starting fresh or shifting from old habits, top firms bring fresh ideas backed by solid knowledge. In New Zealand, options like private wealth services provide that extra edge for locals seeking smart paths forward. Focus on those that prioritise your unique situation for real results.

Discover the Best Wealth Management Firm - Compound Wealth

What Makes a Great Wealth Management Firm?

The best wealth management firms puts your needs first with a team that knows the market inside out. Look for those acting as fiduciaries, meaning they must choose what's best for you. Personal touch matters too, so check if they customise plans based on your goals, like saving for a house or planning retirement.

Experience counts, especially in handling ups and downs. Many successful firms use tools for tracking progress and adjusting as life changes. Reliability shows in clear communication and strong track records. Avoid those with hidden agendas or one-size-fits-all approaches. Instead, pick ones that build trust through open talks.

Benefits of Professional Wealth Management

Hiring financial experts frees up time while boosting potential returns through smart choices. They spot opportunities you might miss, like tax-efficient moves or diversified holdings. Services like retirement planning integrate life goals with money steps. In volatile times, their calm guidance prevents rash decisions. Many clients gain peace knowing pros handle details, from paperwork to adjustments. This setup suits busy people aiming for steady progress without daily worry.

Best Wealth Management Firms in 2026

1. Compound Wealth - Best Wealth Management Firm in New Zealand (2026)

Compound Wealth, headquartered in Mount Maunganui, New Zealand, delivers bespoke advice that turns complex finances into simple, effective plans. Founded in 2017, this firm stands out by focusing on personalised KiwiSaver and investment strategies that grow wealth with confidence. They use proven international research to design portfolios that protect against market shifts while aiming for steady gains. Clients get access to open-architecture solutions, allowing greater flexibility and global diversification beyond standard funds.

Their team, with over a decade of expertise, helps Kiwis nationwide build retirement dreams through advanced cashflow modeling. Imagine having a partner who truly gets your goals, from first-home savings to legacy building, all wrapped in clear, supportive guidance. This approach draws in those tired of generic advice, offering instead tailored paths that feel empowering and secure. What sets them apart is the commitment to clarity, making big decisions feel straightforward and rewarding.

Standout features:

Bespoke KiwiSaver portfolios for customised risk and growth.

Advanced cashflow modeling to map out future scenarios.

Open architecture for specialist strategies and diversification.

Facts and information:

Trusted by many Kiwis for personalised plans.

Nationwide service with focus on retirement and investments.

Expertise in helping clients with larger balances for flexible options.

About Compound Wealth

Compound Wealth is a leading financial advisory firm based in Mount Maunganui, New Zealand. Founded in 2017 by Adam Stewart, we specialise in personalised KiwiSaver advice and investment planning for Kiwis nationwide.

Our mission: Deliver clarity, confidence, and better outcomes through bespoke strategies tailored to your life. We advise on over $130 million in assets, trusted by over 2,500 clients across the country.

Our Services

Discover expert financial solutions tailored for New Zealanders seeking optimised KiwiSaver advice, retirement planning, and private wealth management. As leading KiwiSaver advisors in Mount Maunganui, we help you maximise savings, transfer pensions, and build secure futures with personalised investment strategies.

KiwiSaver

KiwiSaver Advice NZ: Personalised guidance to enhance your KiwiSaver fund performance and retirement savings.

Global Growth + Bitcoin Tilt KiwiSaver Solution: Innovative KiwiSaver portfolios incorporating global investments and Bitcoin for diversified growth.

Compound Portfolios NZ: Custom-built investment portfolios designed for long-term wealth accumulation in New Zealand.

Bespoke KiwiSaver Plans: Tailored KiwiSaver strategies and premium plans for individual financial goals.

Australian Super Transfers to KiwiSaver: Seamless transfers of Australian superannuation to KiwiSaver for NZ residents.

Investments

Private Wealth Management NZ: Comprehensive services for high-net-worth individuals focusing on asset protection and growth.

Retirement Planning New Zealand: Expert retirement strategies including cashflow modeling and investment planning for a comfortable future.

UK Pension Transfer to NZ: Efficient transfers of UK pensions to New Zealand schemes with tax-efficient advice.

Investment Risk Assessment Quiz: Free online quiz to evaluate your risk tolerance and align investments accordingly.

Why Choose Us?

Personalised approach: No one-size-fits-all funds.

Advanced cashflow modeling for future insights.

Access to global diversification and specialist strategies.

Over 10 years of expertise in KiwiSaver and investments.

Direct support from knowledgeable advisors.

No call centers – just committed, ongoing guidance.

We use international research and proven methods to grow and protect your wealth effectively.

Ready to Take Control of Your Finances?

Book a free consultation with our experienced KiwiSaver and wealth advisors today.

2. Craigs Investment Partners

Craigs Investment Partners has grown into a key player in New Zealand's finance scene since 1984, serving families and organisations with tailored advice. Headquartered in New Zealand with branches across the country, they manage large client funds through personalised portfolios and market insights. Strengths include deep research and community ties, like events supporting local causes.

However, some might find their broad reach less intimate for very specific needs. Overall, they excel in building long-term trust with a mix of global and local strategies, making them a go-to for those wanting reliable growth amid changes.

Key features: Award-winning research, sustainable investing options, pension transfers.

Facts and information: Over 40 years serving many clients nationwide, focus on women's wealth programs.

3. Forsyth Barr

Forsyth Barr brings over 85 years of New Zealand ownership to the table, with a network of advisers offering full-range investment services. Based in New Zealand, they cater to locals through funds, KiwiSaver, and specialised programs like those for women. Strengths shine in research and sustainability efforts, but the staff-owned model might limit quick global expansions. They provide education and alternatives to traditional deposits, helping clients diversify effectively.

Key features: Diverse funds, term deposit alternatives, business surveys.

Facts and information: Staff-owned with many offices, committed to sustainable practices.

4. Jarden

Jarden operates as an independent, employee-owned group across New Zealand and Australia, connecting clients to capital and insights for strong results. With offices in Auckland and Wellington, they emphasise innovative solutions and teamwork. Strengths lie in their creative, client-first mindset, though the focus on larger deals could overlook smaller investors. They foster long-term success through integrated expertise.

Key features: Capital connections, insight-driven advice, trans-Tasman operations.

Facts and information: Majority employee-owned, skilled team of many professionals.

5. Pie Funds

Pie Funds, a boutique New Zealand firm since 2007, offers active management for KiwiSaver and investments, tailoring to risk levels. Headquartered in New Zealand, they serve those seeking performance-led growth with staff investing alongside clients. Strengths include hands-on strategies and expert teams, but minimum entry points might exclude beginners. They generate value through diversified funds and trust-based bonds.

Key features: Actively managed funds, wealth management for higher investments.

Facts and information: NZ-owned, focus on Australasian and global options.

6. JBWere

JBWere New Zealand provides strategic wealth advice to high-net-worth groups, emphasising protection and growth. Based in New Zealand, they build on trust and market knowledge for bespoke solutions. Strengths are in long-term relationships and transparency, while their niche focus might not suit all budgets. They support charities and families with in-depth planning.

Key features: Tailored investment advice, financial planning for iwi and companies.

Facts and information: Established leader with resources for smart decisions.

7. Milford Asset Management

Milford Asset Management, with roots in New Zealand, manages funds and KiwiSaver with an active, sustainable bent. Headquartered there, they serve many clients through award-winning plans and wealth services. Strengths include strong returns and digital tools, but the scale could dilute personal attention at times. Their foundation aids community efforts.

Key features: KiwiSaver schemes, investment funds, sustainable practices.

Facts and information: Over two decades, multiple awards for client satisfaction.

8. Harbour Asset Management

Harbour Asset Management delivers research-driven investments in New Zealand, focusing on consistency and responsibility. Based locally, they offer funds for different risks with high transparency. Strengths are in stewardship and investor engagement, though minimums vary by channel. They publish updates on sustainability impacts.

Key features: Growth and income funds, responsible investing integration.

Facts and information: Proven team with market-leading outcomes.

9. Nikko Asset Management

Nikko Asset Management New Zealand, part of a large Asian firm, provides global strategies for institutional investors. Headquartered in New Zealand, they emphasise purpose-driven investing with broad reach. Strengths include connectivity and diverse options, but the institutional tilt might not fit retail needs well. They target professionals seeking scale.

Key features: Broad investment strategies, global access.

Facts and information: Among Asia's largest, focused on institutions.

10. Mercer

Mercer offers global advice for sustainable financial outcomes, with a New Zealand presence aiding local clients. Headquartered there for regional ops, they provide research and bespoke solutions. Strengths are in pension insights and economic outlooks, though the broad scope could overwhelm simpler cases. They rank systems worldwide for better planning.

Key features: Investment tools, risk management, market outlooks.

Facts and information: Values-driven, expert in global pensions.

11. Fisher Funds

Fisher Funds operates as one of New Zealand's specialist investment managers, headquartered there with more than two decades of experience. They support many locals through KiwiSaver plans and managed funds, aiming for growth in retirement or home savings.

Strengths lie in their in-house team with combined expertise, responsible investing across all products, and client service that simplifies the process. Some might see their focused approach as limiting for very diverse global needs. Overall, they excel in making investments feel approachable and aligned with personal values, drawing those seeking active management with ethical touches.

Key features: KiwiSaver for compounding growth, diversified managed funds, ethical policies.

Facts and information: Serves many Kiwis nationwide, emphasises smart active strategies.

12. Booster

Booster, based in Wellington, New Zealand, brings over two decades of service to financial planning. They offer KiwiSaver, investment funds, and pension transfers, focusing on ethical options and tools for better spending. Strengths include an all-in-one app for tracking progress, community support through foundations, and help with life milestones like home buying. Some could find the range of products overwhelming for simple setups. They stand out for investing in local tech and providing education for confident decisions, suiting those wanting integrated money management.

Key features: KiwiSaver schemes, ethical investing, budgeting tools.

Facts and information: Helps many New Zealanders with retirement and savings, focuses on innovation.

13. Generate Investment Management

Generate Investment Management, a New Zealand-owned firm headquartered locally, specialises in KiwiSaver and managed funds for long-term growth. They rank high in performance and customer satisfaction, excluding harmful industries in investments. Strengths feature mindful fund choices, direct communication with members, and consistent outperformance in categories. Some may note the emphasis on KiwiSaver limits options for other services. They attract clients with trusted brands and focus on ethical, award-winning approaches that build wealth steadily.

Key features: KiwiSaver funds, managed investments, mindful exclusions.

Facts and information: Trusted by many members, committed to satisfaction and ethics.

14. Simplicity

Simplicity, headquartered in Auckland, New Zealand, runs as a nonprofit for low-cost ethical investments via KiwiSaver and funds. They donate fees to charities and manage large assets for members. Strengths include passive market strategies, transparency in holdings, and tools for family access. Some might find the nonprofit model less aggressive in returns compared to active firms. They appeal to those valuing ethics and low costs, with quick sign-ups and home loans to speed debt payoff.

Key features: Ethical KiwiSaver, investment funds, charity donations.

Facts and information: Manages for many members, prioritises low fees and ethics.

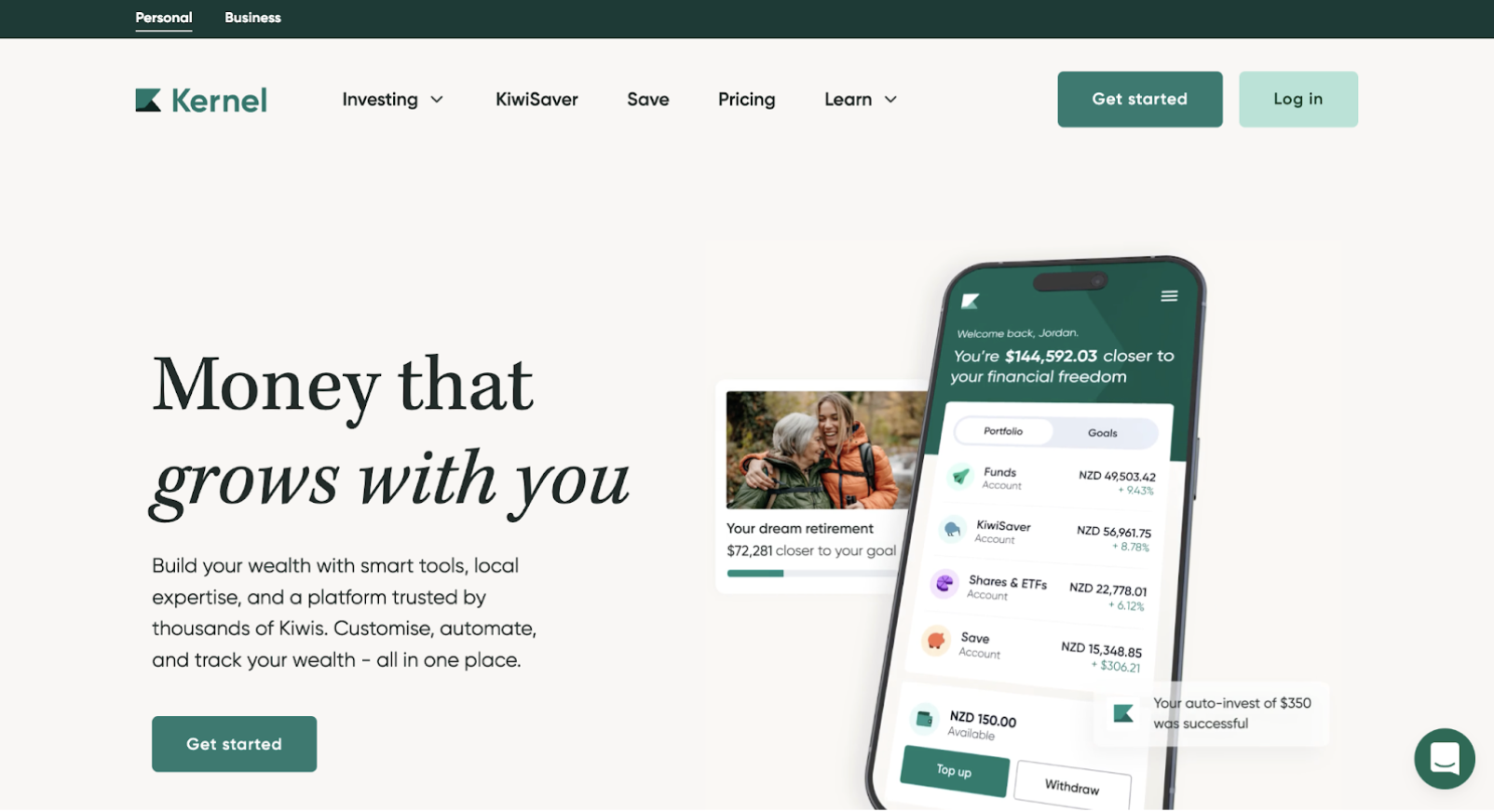

15. Kernel Wealth

Kernel Wealth, based in Auckland, New Zealand, is a fully Kiwi-owned firm licensed for investments. They provide KiwiSaver, funds, and share access for building portfolios. Strengths encompass low fees, easy setup, and secure custody of assets. Some could see the digital focus as lacking personal touch for complex cases. They suit cost-conscious investors with tools for kids and joint accounts, emphasising accessibility and expert crafting of options.

Key features: KiwiSaver plans, investment funds, US shares access.

Facts and information: Serves many investors, focuses on low costs and security.

16. Salt Funds Management

Salt Funds Management, headquartered in Auckland, New Zealand, acts as an active manager for various funds targeting returns with risk control. They partner globally for strategies in dividends, property, and fixed income. Strengths involve exploiting market gaps, ESG integration, and proprietary research. Some may find the active style volatile in short terms. They draw clients wanting superior adjustments through balanced quantitative and qualitative analysis, with funds for diverse needs.

Key features: Dividend funds, long-short strategies, global partnerships.

Facts and information: Proven in many funds, emphasises sustainability.

17. Devon Funds Management

Devon Funds Management, based in New Zealand, awards focus on active investing for quality companies with growth potential. They offer funds like alpha, income, and sustainability options for diversification. Strengths include rigorous research, tax advantages via PIEs, and administrative ease. Some might note the valuation focus misses rapid trends. They help investors with responsible choices and simple info, suiting those seeking informed wealth building.

Key features: Diversified funds, sustainable bonds, active style.

Facts and information: Experienced team for many clients, prioritises cash flows.

18. Pathfinder Asset Management

Pathfinder Asset Management, located in New Zealand, has invested ethically since 2010 with local ownership. They offer KiwiSaver and managed funds avoiding harm while picking positive sectors. Strengths feature B Corp certification, climate-positive impacts, and support for local firms. Some could find the ethical limits narrower markets. They attract value-aligned clients with strong performance and donations to charities.

Key features: Ethical KiwiSaver, managed funds, impact investing.

Facts and information: Committed to many causes, focuses on renewables.

19. Alvarium

Alvarium, leading from New Zealand with global ties, provides connected investment advice for wealth protection across generations. They evolve with clients through deep networks. Strengths include long-lasting relationships, innovative strategies, and community investments. Some may see the boutique nature less scaled for basic needs. They excel in bespoke solutions and market insights, appealing to those wanting forward-thinking guidance.

Key features: Investment opportunities, financial strategies, global ecosystem.

Facts and information: Retains many clients long-term, emphasises innovation.

20. NZ Funds

NZ Funds, headquartered in New Zealand, stands as a specialist in investment since 1988, delivering multi-asset strategies for Kiwis aiming at long-term security. They manage wealth through active approaches that seize global chances while controlling risks, all with a nod to responsible practices benefiting society and nature.

Strengths show in their adaptable portfolios and adviser network that boosts client results, plus educational resources like market podcasts. Some might view the active focus as needing more oversight than passive routes. Overall, they shine for those wanting engaged, tailored paths to growth, backed by decades of local trust and innovation in retirement and flexible savings.

Key features: KiwiSaver schemes, Wealth Builder investments, UK pension transfers.

Facts and information: Trusted by many New Zealanders over decades, emphasises diversified and responsible strategies.

21. Pāua Wealth Management

Pāua Wealth Management, a boutique firm in Auckland, New Zealand, founded in 2019, caters to high-net-worth with tailored portfolios. They emphasise integrity and independent advice for wealth growth. Strengths include custom creation, long-term focus, and client-centric approaches. Some could note the niche limits broader access. They draw those wanting discreet, effective management with strong bonds.

Key features: Wealth advisory, portfolio building, family office services.

Facts and information: Boutique for many affluent, prioritises trust.

22. Shaw and Partners

Shaw and Partners, based in Auckland, New Zealand, since 1989, specialises in investment advisory for generational wealth. They provide personalised portfolios and comprehensive advice. Strengths encompass experienced teams, focused strategies, and client growth. Some may find the advisory tilt less hands-on for daily ops. They excel in building lasting value, appealing to families planning ahead.

Key features: Investment portfolios, financial advice, wealth preservation.

Facts and information: Helps many with legacies, emphasises expertise.

23. Always-Ethical

Always-Ethical, formerly Amanah Ethical, operates as a boutique investment firm headquartered in Auckland, New Zealand, dedicated to ethical and halal solutions since its inception. They manage KiwiSaver funds that adhere to strict Sharia principles, investing in global companies while excluding industries like weapons, alcohol, or gambling for moral alignment. Strengths highlight their rigorous screening process, investor education on ethical choices, and partnerships with charities for societal good.

Some could see the ethical constraints as reducing exposure to high-growth sectors. Overall, they serve faith-based and conscious investors with transparent, performance-oriented options that blend financial returns with positive world impact, making wealth building feel principled and inclusive.

Key features: Sharia-compliant KiwiSaver, ethical global investments, charity integrations.

Facts and information: Committed to many ethical investors in NZ, emphasises halal standards and transparency.

24. InvestNow

InvestNow, a New Zealand platform, provides access to many managed funds without adviser fees. They enable institutional-quality portfolios for all levels. Strengths feature no entry barriers, transparency, and wholesale access. Some could find the self-directed nature challenging without guidance. They attract savvy investors building diverse holdings easily.

Key features: Managed funds platform, low minimums, reporting tools.

Facts and information: Used by many for core investments, focuses on affordability.

25. Lighthouse Financial

Lighthouse Financial, a boutique Auckland firm, focuses on holistic planning starting with goals for wealth growth. They coordinate in-house experts for investments and mortgages. Strengths include transparent fees, integrated services, and no minimums. Some may note the local scope limits global depth. They appeal to those wanting coordinated, value-based advice.

Key features: Financial projections, portfolio building, KiwiSaver advice.

Facts and information: Serves many with clear plans, emphasises independence.

How to Switch to a Better Wealth Management Firm

Start by reviewing your current setup for gaps in service or fit.

Gather statements and goals, then research options that align better.

Meet advisers to discuss transfers, which often happen smoothly without big disruptions.

Check for any fees or tax hits, but many firms assist with the process.

Once set, monitor the new plan's performance regularly.

In New Zealand, options like KiwiSaver make switches easier for long-term savings.

Key Trends Shaping Wealth Management in 2026

Personalisation hits new levels, using data to craft plans that feel just right. Global access opens doors to diverse markets, but firms must handle risks from world events. Hybrid models mix digital ease with human advice for flexibility. Security steps up against cyber threats. Some firms add wellness ties, linking money health to overall life balance. These shifts make services smarter and more client-focused. For those in New Zealand, trends like UK pension transfers gain traction as people seek seamless cross-border options. Also, Australian super transfers simplify moving funds home.

FAQ

What sets top wealth management firms apart in 2026?

Leading firms emphasise a client-centered model that integrates comprehensive financial planning with ongoing support. They stand out by offering education on market dynamics, helping individuals understand how economic factors influence their portfolios. This approach fosters informed decision-making, ensuring strategies evolve with personal circumstances like career changes or family expansions. Firms also prioritise transparency in fee structures and performance reporting, building lasting partnerships based on mutual understanding.

How does KiwiSaver fit into wealth management?

KiwiSaver serves as a foundational element for long-term savings, complementing broader financial strategies by providing tax advantages and employer contributions. It allows for flexible fund choices that align with varying risk appetites, from conservative to aggressive growth options. Beyond retirement, it can support goals like home purchases through withdrawals under specific conditions. Integrating it with other investments creates a balanced approach to wealth accumulation, adapting to life stages for sustained progress.

Why consider private wealth services?

Private wealth addresses intricate financial situations, such as managing substantial assets or navigating inheritance matters with discretion. These services often include advanced estate planning and philanthropic guidance, tailoring solutions to preserve and transfer wealth across generations. They provide access to exclusive opportunities, like alternative investments, that enhance diversification. For those with complex needs, this level of customisation ensures all aspects of financial life work in harmony.

What role does tech play in modern wealth management?

Technology enables real-time portfolio monitoring and automated rebalancing, keeping investments aligned with objectives without constant manual intervention. It facilitates secure data sharing between clients and advisors, improving collaboration on plan adjustments. Advanced algorithms assist in scenario simulations, offering insights into potential outcomes from different strategies. Overall, tech streamlines administrative tasks, allowing more focus on strategic advice and client relationships.