Get Your

Strategic Wealth Blueprint

Integrated planning and comprehensive investment strategy for people who want clarity, structure, and long-term visibility.

Now advising on over $130m for clients nationwide

Who this is the Strategic Wealth Blueprint designed for?

I am dedicated to building with purpose and clarity.

This tier is for clients who want more than an investment setup. It’s for people who want a full strategic blueprint that brings everything together: goals, cashflow, retirement projections, and a coordinated investment plan across all assets.

You may be a good fit if you:

Want clear long-term direction, not just product selection

Need scenario planning to make confident decisions

Have competing goals (home, kids, business, retirement) and want priorities mapped

Value a structured adviser relationship with ongoing oversight

If you only need KiwiSaver and personal investment setup, KiwiSaver and Investments may be the right fit.

What’s Included

Full holistic financial planning and scenario modelling

A complete view of your financial life, bringing together income, assets, liabilities, goals, and risks. We model different scenarios so you can see how decisions today may affect future outcomes, helping you make choices with greater clarity and confidence.

Detailed cash-flow forecasting and goal prioritisation

A forward-looking view of how money flows in and out over time, mapped against your priorities. This helps identify trade-offs, timing decisions, and what needs to happen first so your goals remain realistic and achievable.

Retirement projections with multiple scenario testing

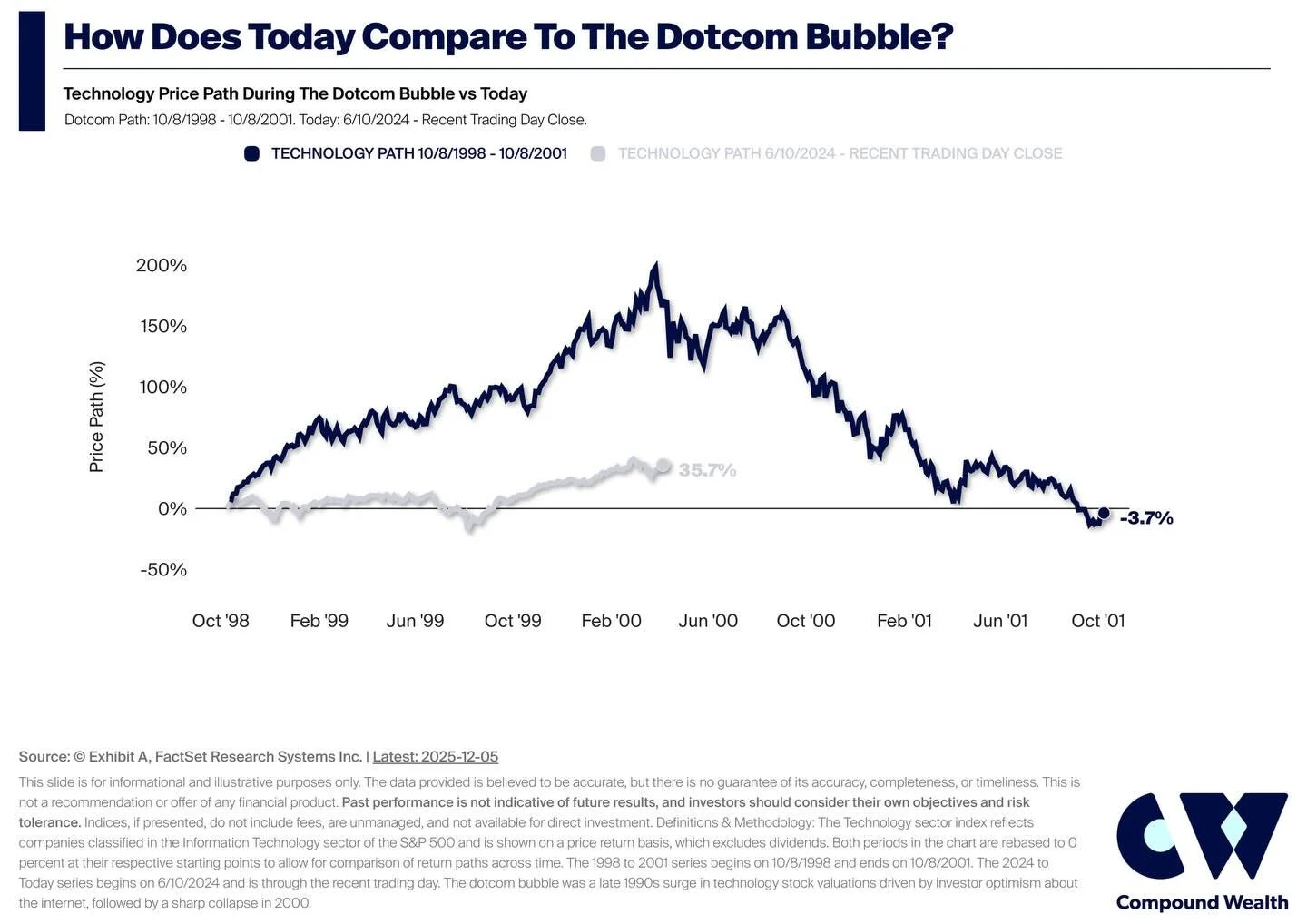

Clear projections showing how your retirement may look under different assumptions, such as retirement age, spending levels, market conditions, or changes in income. This allows you to understand the range of possible outcomes and adjust plans early, rather than reacting later.

Coordinated investment strategy across all assets

A single, integrated investment approach that considers all of your investments together, not in isolation. This ensures risk, asset allocation, and strategy are aligned across KiwiSaver, personal investments, and other assets, reducing unnecessary complexity and duplication.

A comprehensive written strategic plan aligning your money with your values and desired lifestyle

A clear, practical written plan that documents your goals, priorities, and agreed strategy. It explains what you’re working towards, how your money is structured to support that, and why each recommendation was made.

Sustainable retirement income and drawdown strategies

A plan for how to use your savings in retirement, not just how to build them. This includes guidance on spending levels, withdrawal order, and investment positioning to help your money last while supporting the lifestyle you want.

Annual formal review, proactive rebalancing, performance monitoring, and tailored ongoing advice

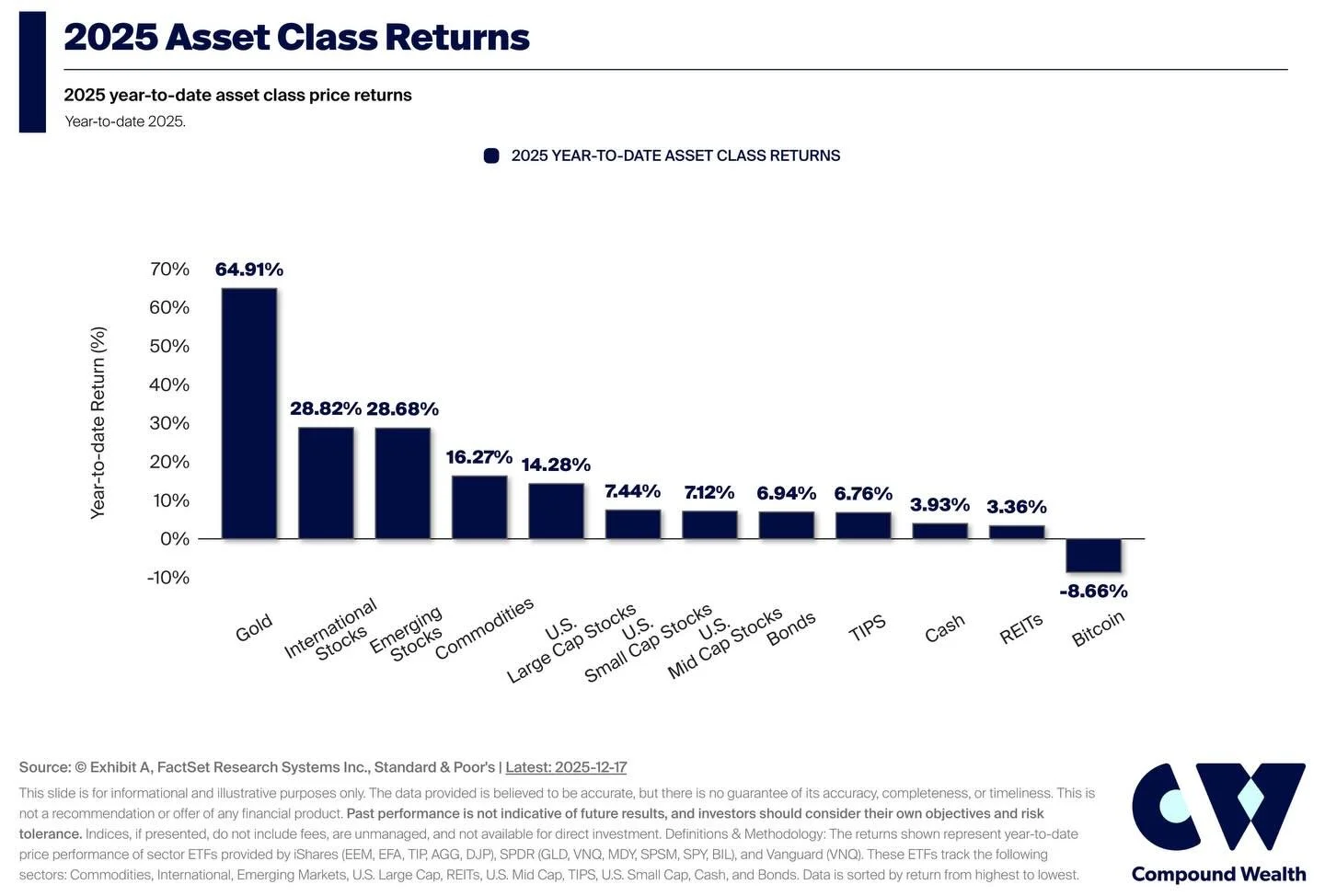

A structured annual review process, supported by ongoing monitoring throughout the year. Portfolios are rebalanced when needed, performance is assessed in context, and advice is adjusted as your circumstances or markets change.

Investment

$12,500 incl. GST for strategy development and implementation

Ongoing advice fee: Up to 1.15% p.a. incl. GST on advised assets (depending on portfolio composition and complexity), reducing progressively with larger balances toward 0.25% p.a.

Our partners