Best Wealth Management Consultants in 2026

Finding the right wealth management consultant matters a lot in today's market. These professionals help you grow and protect your assets through smart strategies. Whether you're planning for retirement or building a portfolio, the best ones offer clear guidance without ties to specific products. Discover the best wealth management consultants in 2026 to guide your financial decisions in New Zealand.

Discover the Best Wealth Management Consultants in 2026 - Compound Wealth

What Makes a Great Wealth Management Consultant

A solid wealth management consultant brings expertise in investments, risk handling, and goal setting. They assess your situation and craft plans that match your aims, like saving for a house or retirement. Look for those with strong track records in New Zealand's economy, where factors like property and superannuation play big roles. Independence counts too, so you get unbiased picks from across the market.

Many consultants now blend tech with personal touch for better outcomes. After picking one, review your plan yearly to stay on track. For those with overseas funds, services like UK pension transfer can smooth the process. Or if you have Aussie assets, Australian super transfers help bring everything together under one roof.

How Wealth Management Fits into New Zealand's Economy

Wealth managementv ties closely to New Zealand's growth sectors, like tech and agriculture. Consultants help navigate rules around taxes and super schemes for better returns. With rising living costs, some people seek ways to diversify beyond traditional banks. This approach builds resilience against market shifts.

In 2026, focus on consultants who understand local laws and global trends. They often use tools for risk checks, like a risk assessment quiz, to tailor advice. Pairing this with retirement planning ensures your later years stay secure.

Best Wealth Management Consultants in 2026

1. Compound Wealth - Best Wealth Management Consultant

With private wealth services at the core, Compound Wealth stands out as an independent adviser based in Mount Maunganui, New Zealand. This firm delivers tailored strategies that put your goals first, free from product biases. They guide you through building structured portfolios that grow over time, using clear models to project your future wealth. Clients get ongoing support to adjust as life changes, whether starting a family or nearing retirement.

Their approach mixes discipline with flexibility, helping you avoid common pitfalls like emotional trades. Many Kiwis praise the straightforward advice that simplifies complex choices. Compound Wealth focuses on empowerment, so you feel confident in your path. They handle everything from initial reviews to seamless switches, making the process hassle-free. This dedication sets them apart in a crowded field, offering peace of mind through proven methods.

Standout features include bespoke portfolio builds that diversify across assets for steady growth.

Clients benefit from detailed cashflow projections that map out long-term scenarios.

Independent selections mean access to top market options without hidden agendas.

Facts and information show their advice covers nationwide clients with varied needs, from young savers to high-net-worth individuals.

User benefits come from personalised sessions that clarify risks and opportunities.

About Compound Wealth

Compound Wealth is a leading financial advisory firm based in Mount Maunganui, New Zealand. Founded in 2017 by Adam, we specialise in personalised KiwiSaver advice and investment planning for Kiwis nationwide.

Our mission: Deliver clarity, confidence, and better outcomes through bespoke strategies tailored to your life. We advise on over $130 million in assets, trusted by over 2,500 clients across the country.

Our Services

Discover expert financial solutions tailored for New Zealanders seeking optimised KiwiSaver advice, retirement planning, and private wealth management. As leading KiwiSaver advisers in Mount Maunganui, we help you maximise savings, transfer pensions, and build secure futures with personalised investment strategies.

KiwiSaver

KiwiSaver Advice NZ: Personalised guidance to enhance your KiwiSaver fund performance and retirement savings.

Global Growth + Bitcoin Tilt KiwiSaver Solution: Innovative KiwiSaver portfolios incorporating global investments and Bitcoin for diversified growth.

Compound Portfolios NZ: Custom-built investment portfolios designed for long-term wealth accumulation in New Zealand.

Bespoke KiwiSaver Plans: Tailored KiwiSaver strategies and premium plans for individual financial goals.

Australian Super Transfers to KiwiSaver: Seamless transfers of Australian superannuation to KiwiSaver for NZ residents.

Investments

Private Wealth Management NZ: Comprehensive services for high-net-worth individuals focusing on asset protection and growth.

Retirement Planning New Zealand: Expert retirement strategies including cash flow modelling and investment planning for a comfortable future.

UK Pension Transfer to NZ: Efficient transfers of UK pensions to New Zealand schemes with tax-efficient advice.

Investment Risk Assessment Quiz: Free online quiz to evaluate your risk tolerance and align investments accordingly.

Why Choose Us?

Personalised approach: No one-size-fits-all funds.

Advanced cash flow modelling for future insights.

Access to global diversification and specialist strategies.

Over 10 years of expertise in KiwiSaver and investments.

Direct support from knowledgeable advisers like Adam.

No call centres – just committed, ongoing guidance.

We use international research and proven methods to grow and protect your wealth effectively.

Ready to Take Control of Your Finances?

Book a free consultation with our experienced KiwiSaver and wealth advisers today.

2. Craigs Investment Partners

Craigs Investment Partners, a well-established firm in New Zealand, delivers personalised wealth advice aimed at fostering strong, ongoing relationships with clients. Headquartered in Tauranga, they have branches across the country, making them accessible for many Kiwis. With a history spanning several decades, the company emphasises comprehensive portfolio management, drawing on deep market insights to guide investment choices. They assist with asset allocation, ensuring diversification across equities, bonds, and other instruments to match individual risk profiles. For retirement planning, they offer strategies that integrate superannuation and long-term growth plans.

Some clients appreciate the firm's commitment to ethical investing, incorporating sustainable options where possible. However, a few note that their methods lean toward conventional practices, which might not appeal to those seeking highly innovative or digital-first solutions. The team's expertise in New Zealand's economic landscape helps navigate local challenges like property market fluctuations and tax regulations. Craigs also provides educational resources to empower clients, promoting informed decision-making. This approach makes them a solid pick for investors who prioritise reliability and personal interaction over flashy tech integrations. Overall, their service caters well to a broad range of needs, from beginners building wealth to seasoned individuals preserving assets.

Key features cover diversified investments, access to bonds, and equity research.

Capabilities extend to superannuation advice and estate planning basics.

Facts and information reveal a nationwide presence with branches in major cities.

Performance stats indicate consistent handling of market ups and downs.

Market insights draw from in-house analysts for informed decisions.

3. Forsyth Barr

Forsyth Barr stands as a full-service investment entity in New Zealand, specialising in wealth management through strategies backed by thorough research. Based in Dunedin, with offices nationwide, they support clients in managing shares, fixed income securities, and various managed funds. Their advisers deliver timely updates on economic developments, aiding clients in adjusting portfolios amid changing conditions. Many value the firm's integration of local and international perspectives, which broadens investment horizons. They also focus on risk mitigation, using tools to assess and balance exposures effectively. For those interested in bonds, Forsyth Barr offers robust options tied to New Zealand's government and corporate issues.

Some users highlight the benefit of their corporate finance connections, which can provide unique opportunities. On the downside, a few mention that the service might seem less customised for very small portfolios, potentially feeling more geared toward institutional clients. The firm's commitment to transparency includes regular reporting and client education sessions. This helps build trust and long-term partnerships. In essence, Forsyth Barr appeals to investors who seek a blend of tradition and analytical depth in their wealth journey, ensuring decisions align with personal goals while considering broader market dynamics.

Key features involve in-depth market reports and portfolio rebalancing.

Capabilities include access to international markets and Kiwi bonds.

Facts and information highlight their role in New Zealand's stock exchange activities.

User statistics show service to both individuals and institutions.

Market insights focus on sustainable investing trends.

4. Jarden

Jarden serves as a key player in New Zealand's investment scene, combining advisory and brokerage services for effective wealth management. Headquartered in Auckland, they target high-net-worth individuals with bespoke portfolios and in-depth research support. Their team excels in providing access to capital markets, allowing clients to engage with a wide array of opportunities. Jarden's strategies often incorporate economic forecasts to optimise asset growth. Clients benefit from personalised plans that address taxation, inheritance, and growth objectives. Some praise their proactive communication, which keeps investors informed during volatile periods.

The firm also emphasises diversification, spreading risks across sectors like technology and agriculture. However, certain clients point out that the digital platforms could be more intuitive for self-monitoring. Jarden's strength in mergers and acquisitions knowledge adds value for business owners integrating personal and corporate finances. They promote ethical standards, aligning investments with client values where feasible. This comprehensive method suits ambitious investors aiming for substantial returns through informed, strategic moves. Overall, Jarden positions itself as a reliable partner for those navigating complex financial landscapes in New Zealand.

Key features encompass equity trading and wealth preservation tactics.

Capabilities cover mergers advice and asset protection.

Facts and information note their expansion into advisory roles.

Performance metrics reflect strong ties to New Zealand's business scene.

Market insights include forecasts on economic shifts.

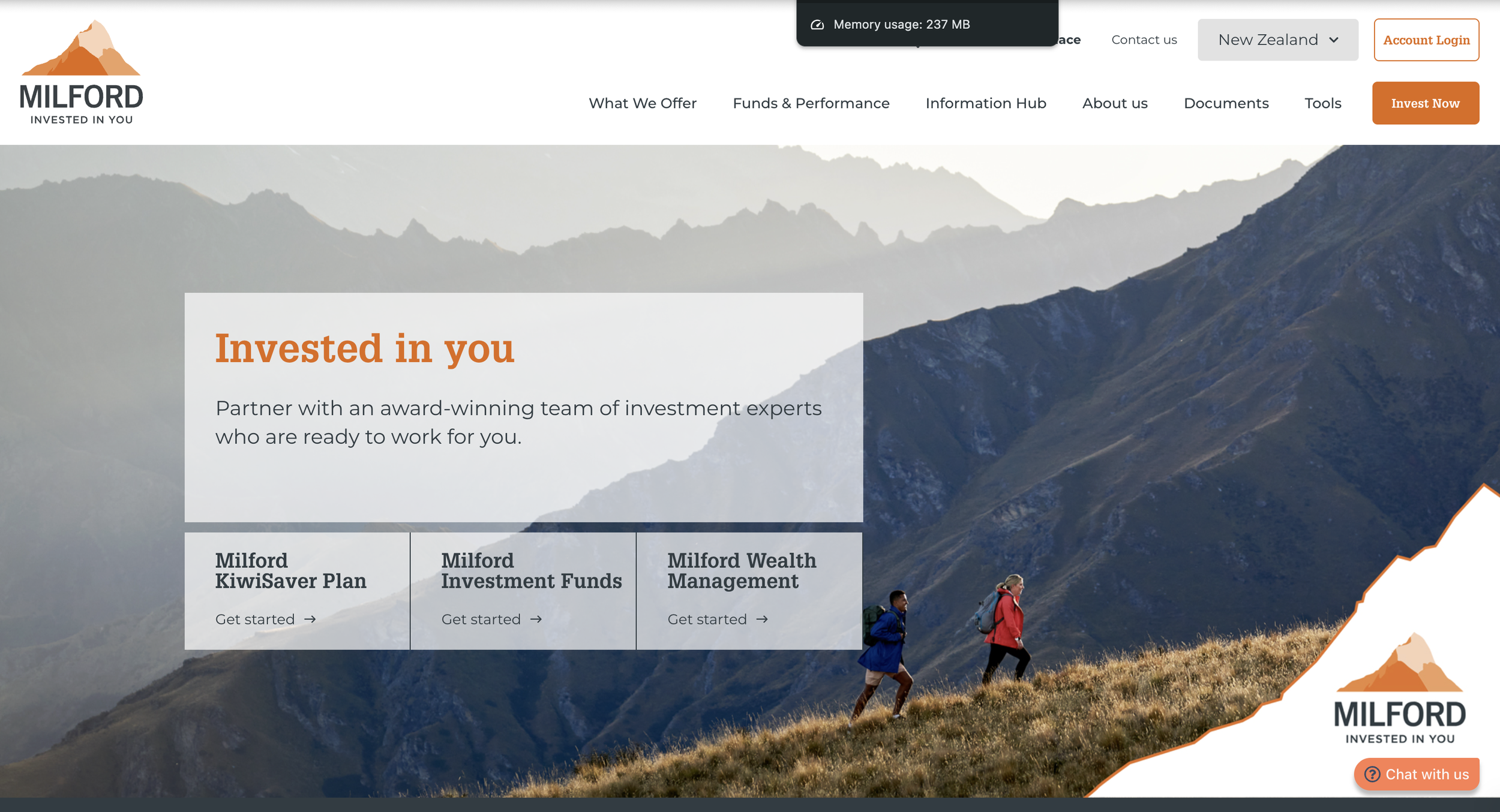

5. Milford Asset Management

Milford Asset Management, situated in Auckland, New Zealand, focuses on active fund management as part of its wealth services. They design portfolios tailored to client risk appetites, with an emphasis on growth-oriented funds. The firm's experienced team conducts rigorous analysis to select promising investments across domestic and global markets. Clients receive regular performance reviews, helping them track progress toward goals like retirement or education funding. Milford stands out for its commitment to sustainable practices, integrating environmental factors into decision-making. Some investors enjoy the accessibility of their funds, which cater to various entry levels.

On the flip side, the active management style can introduce more variability during market downturns, which might concern conservative types. The company offers educational webinars and resources to enhance client understanding. Their approach encourages long-term holding, capitalising on compound growth. Milford also supports KiwiSaver participants with specialised options. This makes them attractive to those who prefer a hands-on, dynamic strategy over passive indexing. In summary, Milford provides a vibrant option for wealth building in New Zealand's evolving economy.

Key features offer diversified funds and regular performance reviews.

Capabilities extend to KiwiSaver schemes and private investments.

Facts and information show management of substantial assets.

User statistics indicate popularity among growth-oriented savers.

Market insights emphasise ethical investing options.

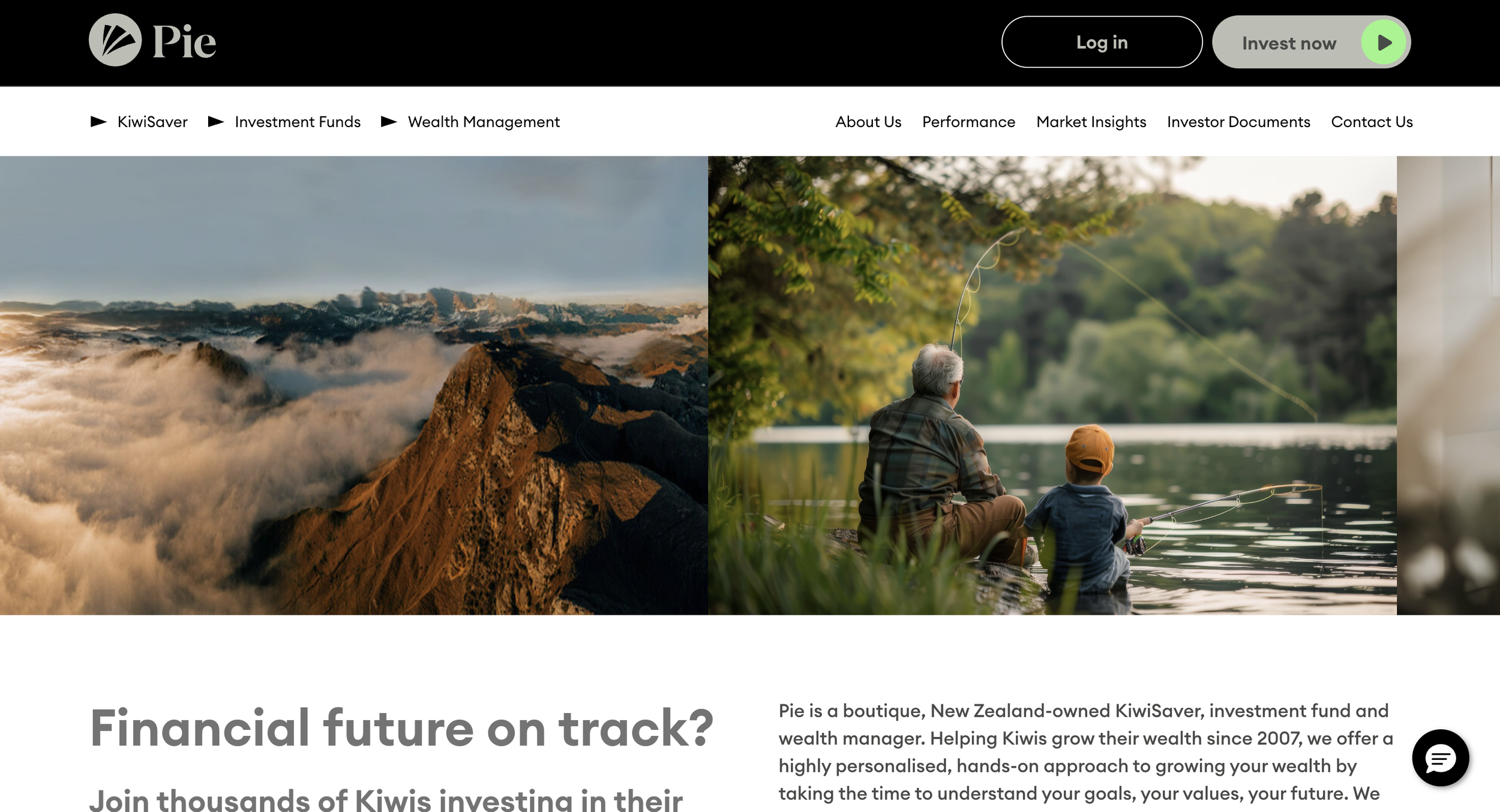

6. Pie Funds

Pie Funds, a boutique operation based in Auckland, New Zealand, specialises in niche wealth management strategies, particularly in small-cap and emerging market investments. They create custom portfolios aimed at achieving higher growth potential for clients. The firm's advisers maintain close contact, offering insights derived from specialised research. Pie Funds differentiates itself by focusing on underrepresented sectors, providing diversification beyond mainstream assets. Clients often appreciate the personalised service, which includes detailed reporting and adjustment recommendations. For those with international interests, they incorporate global equities into plans.

Some note the benefit of their agile approach, allowing quick responses to market opportunities. However, the emphasis on higher-risk areas might not suit everyone, potentially leading to greater fluctuations. The team promotes investor education through newsletters and events. Pie Funds also caters to private wealth needs, including trusts and family offices. This targeted method appeals to adventurous investors seeking alternatives to standard advice. Overall, they offer a fresh perspective in New Zealand's wealth management space, prioritising performance through selective choices.

Key features include fund selection and risk monitoring.

Capabilities cover global equities and alternative assets.

Facts and information reveal a track record in emerging markets.

Performance stats highlight periods of outperformance.

Market insights draw from sector-specific analysis.

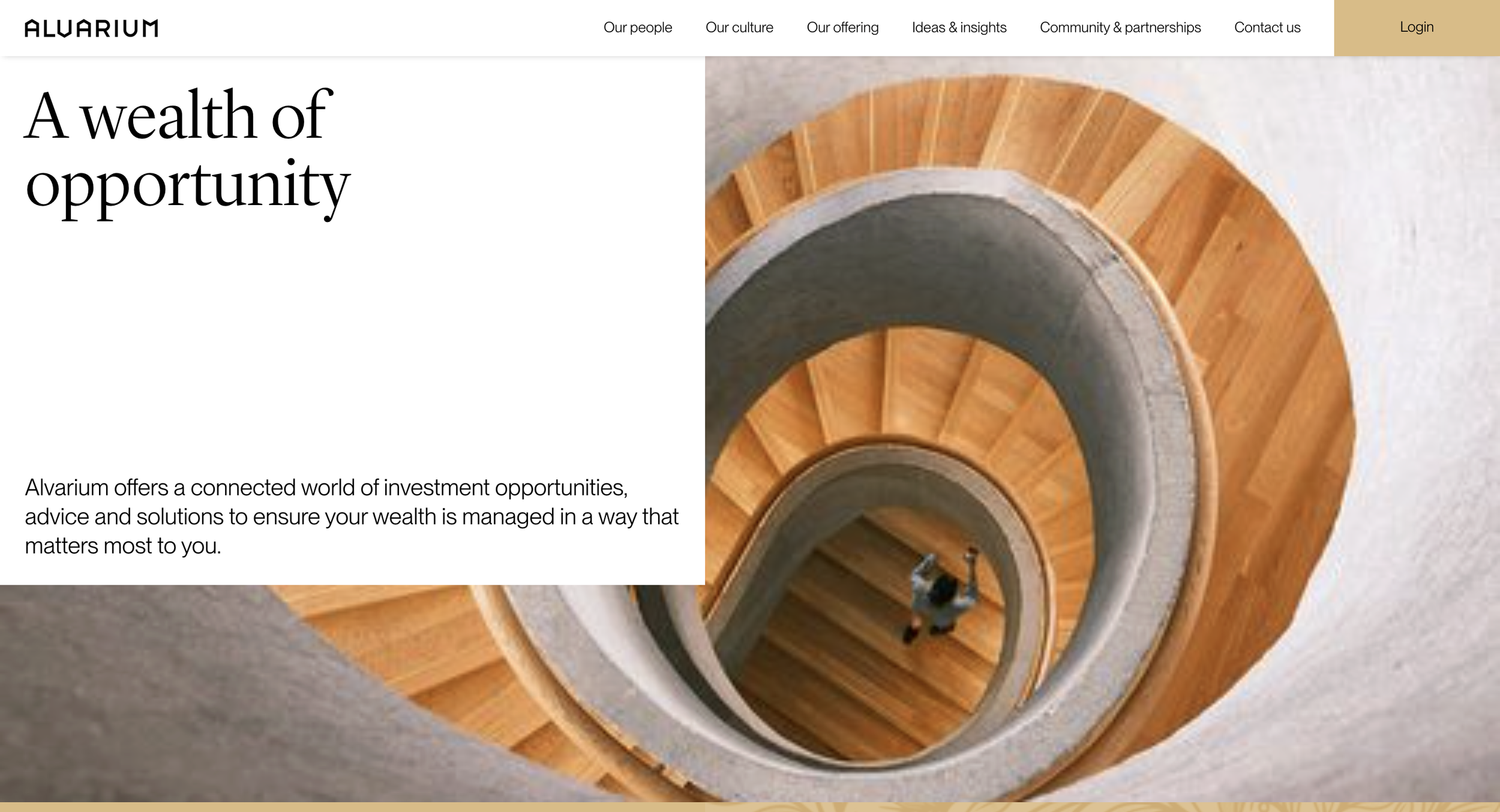

7. Alvarium

Alvarium, operating from New Zealand, links clients to a spectrum of global investment prospects via customised wealth plans. They prioritise alignments with personal values, advising on diverse asset classes including real estate and alternatives. Headquartered in Auckland, the firm leverages international networks for broader access. Clients receive holistic guidance encompassing tax efficiency and legacy planning. Alvarium's team focuses on impact investing, allowing contributions to social causes alongside financial gains.

Some users value the comprehensive reviews that consider life stages. The service includes family office support for complex structures. On occasion, beginners might find the breadth overwhelming without prior experience. Alvarium encourages sustainable growth, integrating ESG criteria. Their approach fosters confidence through transparent processes and ongoing dialogue. This makes them ideal for affluent families pursuing meaningful, long-term wealth strategies. In New Zealand's context, they bridge local and worldwide opportunities effectively.

Key features involve opportunity sourcing and portfolio optimisation.

Capabilities include family office services and impact investing.

Facts and information note ties to worldwide networks.

User statistics show service to affluent families.

Market insights focus on sustainable trends.

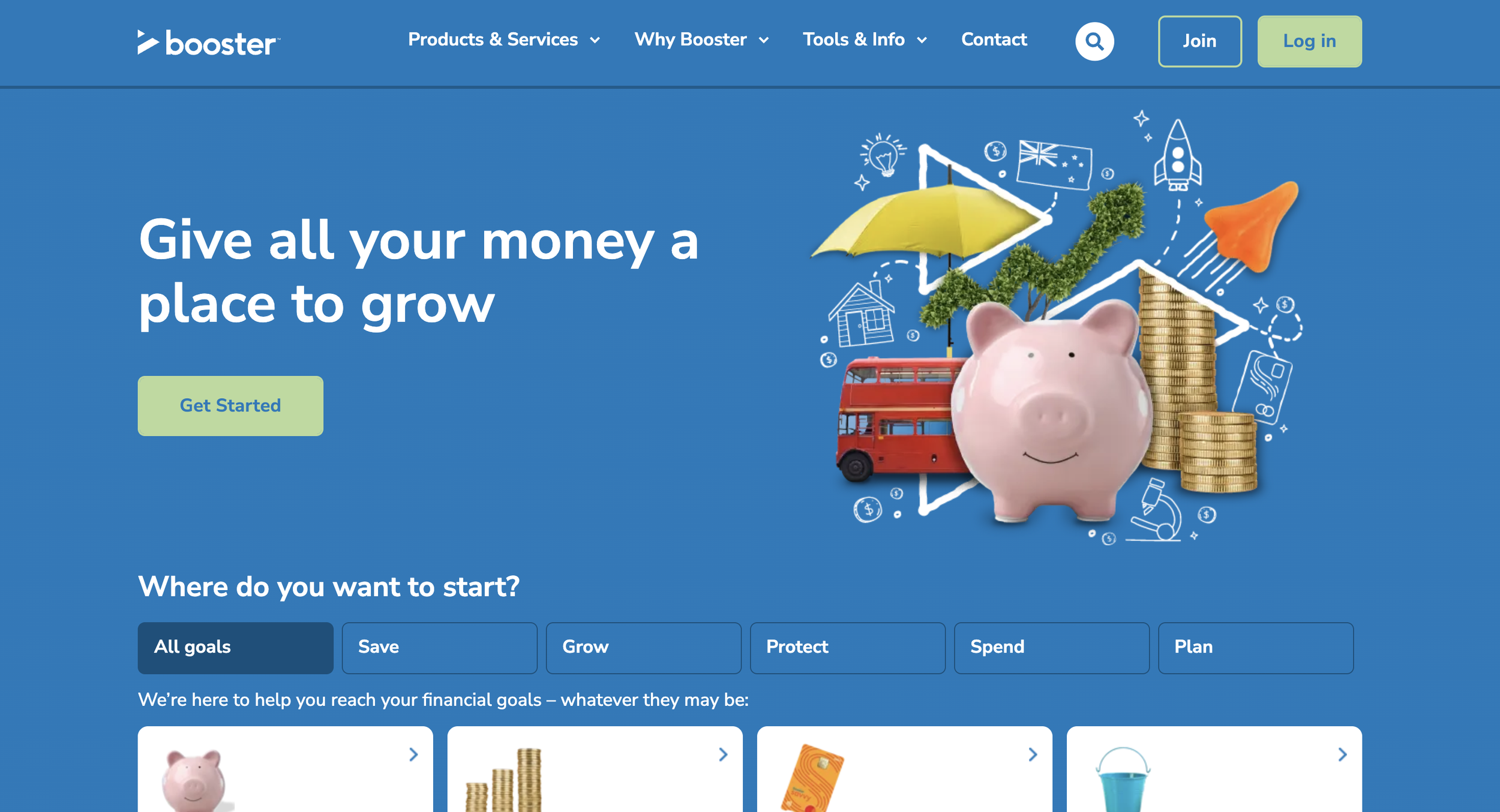

8. Booster

Booster, with headquarters in Wellington, New Zealand, provides wealth management through a range of managed funds and advisory services. They assist clients in setting goal-based plans, incorporating superannuation and insurance elements. The firm's platforms are user-friendly, enabling easy tracking of investments. Booster offers variety in fund choices, from conservative to aggressive profiles. Many clients like the integration of online tools for self-management alongside professional input.

They also emphasise responsible investing, screening for ethical standards. Some find the customisation options sufficient for most needs, though deeper complexities might require additional expertise. Booster supports KiwiSaver enhancements and retirement projections. Their educational content helps demystify financial concepts. This accessible style suits everyday investors aiming for steady progress in New Zealand's market.

Key features cover fund variety and online tools.

Capabilities extend to retirement products and insurance links.

Facts and information indicate growth in client base.

Performance metrics reflect balanced approaches.

Market insights include local economy updates.

9. Kernel Wealth

Kernel Wealth, based in New Zealand, promotes low-cost index investing within its wealth management framework. They deliver diversified funds via straightforward digital platforms, appealing to tech-savvy users. The firm focuses on passive strategies that track market indices for broad exposure. Clients can automate rebalancing and contributions easily.

Kernel's transparency in operations builds trust, with clear fee structures. Some appreciate the simplicity for building long-term wealth without constant oversight. However, those desiring personalised advice might seek more interactive services. Kernel offers educational blogs on indexing benefits. Their approach aligns with New Zealand's growing interest in efficient investing. This makes them a go-to for younger demographics or self-directed planners.

Key features involve index tracking and automated rebalancing.

Capabilities cover broad market exposure.

Facts and information show focus on tech-driven efficiency.

User statistics highlight appeal to younger investors.

Market insights emphasise passive strategies.

10. Private Wealth Advisers

Private Wealth Advisers, a boutique outfit in Auckland, New Zealand, delivers specialised services to individuals, trusts, and iwi organisations. They eschew generic products in favour of fully tailored advice. The firm conducts thorough assessments to craft strategies that address unique circumstances. Clients benefit from trustee support and charitable planning integration.

Some praise the independence, ensuring unbiased recommendations. On the other hand, scale limitations might affect handling of extremely large estates. Their niche expertise shines in complex scenarios, providing clarity and control. This personalised touch fosters strong client loyalty in New Zealand's diverse financial environment.

Key features include trustee support and charity planning.

Capabilities extend to iwi organisations.

Facts and information reveal independent operations.

Performance stats indicate client-focused results.

Market insights draw from niche expertise.

11. JBWere Private Wealth Management

JBWere Private Wealth Management, part of a larger Australasian group, offers sophisticated wealth services in New Zealand. Based in Auckland, they cater to high-net-worth clients with integrated advice on investments, philanthropy, and succession. The firm combines local insights with trans-Tasman resources for comprehensive planning. Clients access premium research and exclusive opportunities in equities and alternatives.

JBWere emphasises holistic wealth preservation, including tax optimisation and family governance. Some value their philanthropic advisory, aiding in impactful giving. The team's multidisciplinary approach covers legal and accounting liaisons. However, the premium positioning might seem exclusive to mid-tier investors. JBWere promotes enduring relationships through dedicated advisers. Their service excels in navigating cross-border issues for Kiwis with Australian ties. This makes them a strong contender for affluent individuals seeking seamless, high-level management in New Zealand.

Key features encompass premium research and philanthropic guidance.

Capabilities include succession planning and cross-border advice.

Facts and information note affiliations with broader financial networks.

Performance metrics show expertise in wealth preservation.

Market insights highlight trans-Tasman economic ties.

12. NZ Funds

NZ Funds, a specialist wealth firm in New Zealand, provides advice and portfolio solutions tailored for local investors. Headquartered in Auckland, they focus on innovative structures like life-cycle investing. The company designs plans that adapt to changing life stages, incorporating super and alternative assets. Clients receive detailed projections and regular adjustments.

NZ Funds stands out for its research-driven selections, avoiding passive trends. Some appreciate the emphasis on downside protection during volatility. They offer educational seminars to enhance financial literacy. On occasion, the bespoke nature might require more client input than standardised options. NZ Funds supports diverse goals, from wealth accumulation to decumulation in retirement. Their approach integrates New Zealand's unique regulatory environment effectively.

Key features offer life-cycle portfolios and risk-adjusted strategies.

Capabilities cover superannuation enhancements and alternatives.

Facts and information indicate specialist focus on Kiwi needs.

User statistics reflect service to varied age groups.

Market insights emphasise adaptive investing.

13. Harbour Asset Management

Harbour Asset Management, based in Wellington, New Zealand, delivers wealth management through active equity and fixed income funds. They prioritise in-depth analysis for superior selections. Clients benefit from portfolios that blend local and Australasian opportunities. Harbour's team provides market commentary to inform decisions.

Some like their sustainable focus, embedding ESG principles. The firm offers KiwiSaver options alongside private advice. However, active styles can vary in short-term results. Harbour fosters transparency with frequent updates. This suits investors who value expertise in New Zealand's core sectors like infrastructure.

Key features include active fund management and ESG integration.

Capabilities extend to fixed income and equity blends.

Facts and information show strong local market presence.

Performance stats indicate focus on long-term value.

Market insights draw from regional economic analysis.

14. Fisher Investments New Zealand

Fisher Investments New Zealand, affiliated with the global firm, serves institutional and private clients with disciplined wealth strategies. Based in Auckland, they employ a top-down approach for asset allocation. Clients get personalised portfolios emphasising global diversification. Fisher provides ongoing education and transparent reporting.

Some praise their fee-only model for alignment. The team addresses retirement and estate needs comprehensively. Yet, the global orientation might overlook niche Kiwi aspects for some. Fisher promotes long-term horizons over tactical shifts. This appeals to those seeking structured, evidence-based management.

Key features encompass global allocation and educational resources.

Capabilities include retirement and estate integration.

Facts and information note international backing.

User statistics highlight institutional service.

Market insights focus on macroeconomic trends.

15. Generate Investment Management

Generate Investment Management, a KiwiSaver specialist in New Zealand, extends to broader wealth advice. Headquartered in Auckland, they offer funds with growth and ethical tilts. Clients receive goal-oriented planning and performance tracking. Generate emphasises accessibility for all investor levels. Some value their community-focused initiatives. The firm provides tools for risk assessment. However, limited international exposure might constrain diversification for some. Generate supports seamless fund switches. This makes them suitable for Kiwis building superannuation steadily.

Key features offer ethical funds and goal planning.

Capabilities cover KiwiSaver and basic wealth advice.

Facts and information indicate focus on accessibility.

Performance metrics reflect steady growth paths.

Market insights emphasise community impacts.

16. Simplicity

Simplicity, based in New Zealand, champions low-fee, passive wealth management through diversified funds. They operate as a non-profit, passing savings to members. Clients access simple KiwiSaver and investment options. Simplicity provides online dashboards for easy oversight. Some appreciate the charitable donations from fees. The approach minimises costs while maximising returns via indexing. Yet, lack of active management might miss opportunities in volatile times. Simplicity educates on passive benefits. This attracts cost-conscious investors in New Zealand.

Key features include low-fee indexing and online tools.

Capabilities extend to KiwiSaver and diversified holdings.

Facts and information show non-profit structure.

User statistics indicate appeal to value seekers.

Market insights highlight passive efficiency.

17. Salt Funds Management

Salt Funds Management, located in Auckland, New Zealand, focuses on alternative and equity strategies for wealth clients. They craft portfolios with a value-oriented lens. Clients benefit from specialist insights in small-caps and dividends. Salt offers managed accounts for customisation. Some like their contrarian tactics for potential upsides. The team provides market updates regularly. However, higher-risk profiles might deter conservatives. Salt integrates ESG where relevant. This suits sophisticated investors pursuing differentiated returns.

Key features encompass value investing and alternatives.

Capabilities include managed accounts and dividends focus.

Facts and information reveal specialist equity knowledge.

Performance stats show contrarian successes.

Market insights draw from value analysis.

18. Devon Funds Management

Devon Funds Management, based in Auckland, New Zealand, provides active wealth services across equities and income funds. They emphasise research for informed picks. Clients get diversified strategies tailored to goals. Devon offers KiwiSaver alongside private portfolios. Some praise their Australasian focus for regional advantages. The firm conducts regular reviews. On the downside, active fees could accumulate. Devon promotes transparency and education. This appeals to Kiwis seeking engaged management.

Key features offer active equities and income options.

Capabilities cover KiwiSaver and regional investments.

Facts and information indicate research depth.

Performance metrics reflect regional expertise.

Market insights emphasise Australasian opportunities.

19. Mercer New Zealand

Mercer New Zealand, part of a global consultancy, delivers wealth management with institutional-grade advice. Headquartered in Auckland, they support superannuation and investment planning. Clients access broad research and risk tools. Mercer focuses on sustainable, long-term strategies. Some value their data-driven insights. The team addresses complex needs like fiduciary duties. However, the corporate scale might feel impersonal for individuals. Mercer offers educational resources. This makes them ideal for organisations and high-net-worth Kiwis.

Key features include institutional research and risk management.

Capabilities extend to superannuation and sustainability.

Facts and information note global affiliations.

User statistics show service to institutions.

Market insights focus on long-term trends.

20. Nikko Asset Management New Zealand

Nikko Asset Management New Zealand, affiliated internationally, provides wealth solutions through funds and advisory. Based in Auckland, they blend global and local expertise. Clients receive diversified portfolios across asset classes. Nikko emphasises innovation in products like ETFs. Some appreciate their Asian market access. The firm offers performance analytics. Yet, the international tilt might overshadow pure Kiwi focus for some. Nikko supports responsible investing. This attracts investors with worldwide views in New Zealand.

Key features encompass ETFs and global diversification.

Capabilities include advisory and fund management.

Facts and information reveal international backing.

Performance stats indicate diversified outcomes.

Market insights highlight Asian influences.

Trends Shaping Wealth Management in 2026

In 2026, wealth management leans toward tech integration for faster insights. Advisers use apps for real-time tracking, helping clients spot opportunities quickly. Sustainability grows as a focus, with many opting for green investments that align with values. Global events influence local plans, so flexible strategies matter more than ever.

Some turn to bitcoin tilts in portfolios for diversification. Pair this with compound portfolios for balanced growth. Insights point to rising demand for hybrid advice that mixes human expertise with digital tools.

Benefits of Starting Wealth Management Early

Getting into wealth management sooner builds compound effects over time. Young professionals gain from early KiwiSaver setups that grow with contributions. This sets up stronger positions against inflation and life surprises. Many find that regular check-ins prevent costly mistakes.

For advanced needs, options like compound pro offer pro-level tools. Early action also opens doors to better tax handling and asset protection. Proactive steps lead to smoother financial paths.

FAQ

What should I ask a wealth management consultant during our first meeting?

Begin with your personal financial objectives and existing assets to set the context. Inquire about their methods for evaluating risks through tools like a risk assessment quiz and adapting to economic shifts. Such discussions reveal if their expertise aligns with your expectations, fostering a collaborative relationship from the start.

How does KiwiSaver fit into overall wealth management?

KiwiSaver serves as a foundational element for accumulating savings over years in New Zealand. It complements broader strategies by adding government incentives and employer matches to enhance growth. Integrating it with other assets creates a robust framework that supports varied life stages without complexity.

Can wealth management help with overseas pensions?

Wealth management consultants assist in managing UK pension transfer or similar moves from abroad. They review compliance requirements and potential implications to ensure smooth integration. Consolidating these funds locally simplifies monitoring and aligns them with your total financial picture.

Why choose independent wealth management over bank options?

Independent wealth management provides access to a full spectrum of market opportunities without institutional biases. Consultants prioritise custom solutions that match individual circumstances for more effective outcomes. This freedom allows for innovative approaches that adapt to personal preferences and evolving needs.

How do wealth management consultants support long-term financial goals?

Wealth management consultants develop strategies that incorporate elements like retirement planning to sustain growth across decades. They monitor progress and adjust for life events, ensuring alignment with aspirations such as legacy building. This ongoing oversight helps maintain focus on objectives amid changing conditions.

Read Also:

2025 Year-to-Date Market Returns: A Reminder of Why Diversification Matters

Best Retirement Investment Planning Services in New Zealand (2026)

Discover the Best Wealth Management Consultants in 2026 - Compound Wealth