Best Wealth Management Solutions in 2026

In 2026, finding the right wealth management solutions means focusing on firms that offer clear, tailored advice to grow and protect your assets. Many New Zealanders turn to these services for help with everything from daily finances to long-term goals like retirement. Discover the best wealth management solutions in 2026 for Kiwis aiming for secure growth and smart planning.

Options vary, with some providing flexible KiwiSaver plans and others handling complex portfolios. The key is picking a provider that aligns with your risk level and life stage, ensuring steady progress without unnecessary hassle. Whether you're starting out or managing substantial wealth, the best choices deliver independent guidance and diversified investments for peace of mind.

Discover the Best Wealth Management Solutions in 2026 - Compound Wealth

What Makes a Great Wealth Management Solution

A solid wealth management solution puts your goals first, blending expert advice with tools that fit your lifestyle. It covers areas like investment selection, risk assessment, and ongoing support to adapt as markets change. Firms that stand out use open structures, allowing access to a wide range of global options rather than limited in-house products. This approach helps in creating balanced portfolios that weather ups and downs. Plus, strong client relationships mean regular check-ins and adjustments, keeping things on track. For Kiwis, local knowledge combined with international insights often leads to better outcomes in volatile times.

Many people find that incorporating KiwiSaver into their strategy boosts long-term savings through employer contributions and government incentives. Services like retirement planning provide cashflow models to map out future needs. If you're dealing with overseas assets, options for UK pension transfers or Australian super transfers can streamline things.

Key Factors to Consider When Choosing a Provider

Pick a provider with a track record of independent advice, free from ties to specific funds that might limit choices. Look for those offering comprehensive reviews of your current setup, identifying gaps and opportunities. Customisation is vital, as one-size-fits-all rarely works for diverse needs like family trusts or business owners. Security and transparency in reporting also matter, giving you clear views of performance without hidden surprises. In New Zealand's market, firms that integrate tax efficiency and estate planning add real value.

Best Wealth Management Solutions in 2026

1. Compound Wealth - Best Wealth Management Solution

Compound Wealth stands out as a top choice for Kiwis seeking independent, tailored financial guidance. This firm has helped many clients since 2017 by crafting personalised plans that focus on growth and protection. Their open-architecture approach lets you access high-quality global managers, avoiding the pitfalls of restricted options.

Whether switching KiwiSaver providers or building diversified portfolios, they provide clear steps to align investments with your risk tolerance and timeline. Clients benefit from detailed modelling that projects long-term outcomes, making decisions feel straightforward and confident. The team emphasises discipline, steering clear of emotional choices during market shifts.

For retirement-focused folks, their strategies integrate cashflow needs with investment choices, ensuring a smooth path ahead. Unique features include bespoke Compound Portfolios that blend traditional assets with innovative tilts, like the Global Growth Bitcoin Tilt KiwiSaver for those open to emerging opportunities. Their Compound Pro service adds layers of professional oversight for complex situations.

Key standout features include flexible diversification across asset classes, regular portfolio rebalancing, and access to unbiased research from international sources.

Their plans often lead to improved alignment with personal goals, with many clients reporting greater clarity in their financial journeys.

About Compound Wealth

Compound Wealth is a leading financial advisory firm based in Mount Maunganui, New Zealand. Founded in 2017 by Adam, we specialise in personalised KiwiSaver advice and investment planning for Kiwis nationwide.

Our mission: Deliver clarity, confidence, and better outcomes through bespoke strategies tailored to your life. We advise on over $130 million in assets, trusted by over 2,500 clients across the country.

Our Services

Discover expert financial solutions tailored for New Zealanders seeking optimised KiwiSaver advice, retirement planning, and private wealth management. As leading KiwiSaver advisers in Mount Maunganui, we help you maximise savings, transfer pensions, and build secure futures with personalised investment strategies.

KiwiSaver

KiwiSaver Advice NZ: Personalised guidance to enhance your KiwiSaver fund performance and retirement savings.

Global Growth + Bitcoin Tilt KiwiSaver Solution: Innovative KiwiSaver portfolios incorporating global investments and Bitcoin for diversified growth.

Compound Portfolios NZ: Custom-built investment portfolios designed for long-term wealth accumulation in New Zealand.

Bespoke KiwiSaver Plans: Tailored KiwiSaver strategies and premium plans for individual financial goals.

Australian Super Transfers to KiwiSaver: Seamless transfers of Australian superannuation to KiwiSaver for NZ residents.

Investments

Private Wealth Management NZ: Comprehensive services for high-net-worth individuals focusing on asset protection and growth.

Retirement Planning New Zealand: Expert retirement strategies including cash flow modelling and investment planning for a comfortable future.

UK Pension Transfer to NZ: Efficient transfers of UK pensions to New Zealand schemes with tax-efficient advice.

Investment Risk Assessment Quiz: Free online quiz to evaluate your risk tolerance and align investments accordingly.

Why Choose Us?

Personalised approach: No one-size-fits-all funds.

Advanced cash flow modelling for future insights.

Access to global diversification and specialist strategies.

Over 10 years of expertise in KiwiSaver and investments.

Direct support from knowledgeable advisers like Adam.

No call centres – just committed, ongoing guidance.

We use international research and proven methods to grow and protect your wealth effectively.

Ready to Take Control of Your Finances?

Book a free consultation with our experienced KiwiSaver and wealth advisers today.

2. Craigs Investment Partners

Craigs Investment Partners, headquartered in Tauranga, New Zealand, has built a strong reputation since its founding in 1984 as a leading provider of personalised wealth management services. The firm caters to families, individuals, and organisations across the country, offering comprehensive advice on investments, portfolio construction, and market strategies. With a nationwide presence, they leverage local insights to help clients integrate assets like property into broader financial plans. Strengths include their extensive network, which ensures accessible support and deep understanding of Kiwi-specific economic factors, making them a go-to for those seeking reliable, community-rooted guidance.

Their approach emphasises long-term relationships, with regular updates and educational resources to empower clients in decision-making. However, the larger scale of operations can sometimes result in processes that feel less agile for highly customised needs in rapidly shifting markets. Overall, Craigs stands out for blending traditional expertise with modern tools, helping many navigate complex financial landscapes effectively. Clients often praise the firm's commitment to transparency and ethical practices, which fosters trust over time. In a competitive field, their focus on holistic planning addresses diverse life stages, from early accumulation to retirement preservation.

Key features: Tailored portfolio management, access to equities and fixed income, client education seminars, nationwide advisory network.

Facts and information: Many clients value the firm's long-standing presence in over 20 locations, providing convenient in-person consultations and localised market knowledge.

3. Forsyth Barr

Forsyth Barr, based in Dunedin, New Zealand, operates as a staff-owned investment firm with roots dating back over 85 years, delivering a wide array of services including sharebroking, portfolio oversight, and research-driven advice. They serve a broad clientele, from individuals to institutions, with an emphasis on long-term stability through informed decisions. Strengths shine in their independent structure, which promotes dedicated service and alignment with client interests, free from external pressures. The firm's nationwide offices facilitate personal interactions, enhancing trust and accessibility for Kiwis in various regions.

They provide tools for cash management and investment in diverse assets, adapting to different risk profiles. On the weaker side, the established processes might occasionally introduce delays in implementing swift changes for dynamic client situations. Forsyth Barr's commitment to education helps demystify markets, making it suitable for those building knowledge alongside wealth. Many turn to them for balanced strategies that incorporate New Zealand's unique economic elements, like agriculture and trade influences. Their approach integrates ethical considerations, appealing to value-driven investors.

Key features: Investment funds selection, short selling options, regular market reports, ESG-focused advice.

Facts and information: Some investors appreciate the staff ownership model, which encourages a client-first mentality and consistent performance focus.

4. Jarden

Jarden, located in Auckland, New Zealand, functions as an employee-owned group extending services across New Zealand and Australia, specialising in connecting clients to capital markets and insightful advice for wealth growth. They target high-net-worth individuals with customised strategies that link local regulations to global opportunities. Strengths are evident in their robust research capabilities and diversified asset allocation, which help in crafting resilient portfolios amid volatility. The firm's independence allows for unbiased recommendations, drawing from a wide network of experts.

They excel in areas like trust advisory and sustainable investing, catering to sophisticated needs. However, the corporate emphasis sometimes shifts priority toward larger clients, potentially reducing attentiveness for smaller portfolios. Jarden's model supports multi-generational planning, ensuring continuity for families. Many clients benefit from their forward-thinking outlook, incorporating trends like technology integration in finance. Overall, they provide a bridge between domestic stability and international expansion, making them ideal for ambitious wealth builders.

Key features: Multi-asset class portfolios, ESG integration, advisory on family trusts, global market access.

Facts and information: Many seek their expertise for comprehensive insights that inform strategic choices in evolving economies.

5. Milford Asset Management

Milford Asset Management, headquartered in Auckland, New Zealand, manages substantial funds with a team of investment specialists offering KiwiSaver and broader wealth services since their inception. They focus on active management to pursue superior returns, backed by experienced professionals. Strengths include their large-scale operations, which enable access to diverse investment vehicles and digital platforms for easy monitoring.

The firm prioritises client satisfaction through awards-recognised schemes, appealing to those seeking proven track records. Regional offices enhance reach, providing support across the country. However, the expansive size can lead to less personalised tweaks in plans, with some overlap in product offerings limiting unique customisation. Milford's approach incorporates future-oriented thinking, like preparing for generational wealth transfer. Many clients value the emphasis on performance and transparency in reporting.

Key features: Active investment funds, online tracking tools, KiwiSaver options, community engagement initiatives.

Facts and information: Some highlight the firm's awards for customer satisfaction as a marker of reliable service.

6. Pie Funds

Pie Funds, based in Auckland, New Zealand, delivers boutique wealth management with operations in New Zealand, Australia, and the UK, emphasising performance-oriented strategies tailored to individual lifestyles. Founded in 2007, they offer hands-on portfolio adjustments for growth-focused clients. Strengths lie in their agile, independent ownership, allowing quick responses to market changes and alignment with client goals.

The global reach provides diverse opportunities, blending local knowledge with international perspectives. They shine in active management, helping clients pursue higher returns through selective investments. A weaker aspect is the specialised focus, which may not cover ultra-broad advisory needs beyond core investments. Pie Funds fosters client-centric reporting, making complex data accessible. Many appreciate the personalised touch in a crowded market.

Key features: Customised growth strategies, international asset exposure, detailed performance analytics.

Facts and information: Many clients note the boutique nature fosters stronger adviser relationships.

7. NZ Funds

NZ Funds, situated in Auckland, New Zealand, has provided portfolio solutions and advisory since 1988, collaborating with a network of advisers to serve diverse clients. They offer active series for specific goals, adapting to various life stages. Strengths include their long history, which brings stability and expertise in KiwiSaver and wealth building.

The partner network expands reach, ensuring widespread access to professional guidance. They focus on income generation and risk-adjusted returns. However, dependence on external advisers might sometimes reduce direct firm engagement for clients. NZ Funds' strategies emphasise adaptability, helping navigate economic shifts.

Key features: Wealth builder programs, income-focused options, KiwiSaver schemes.

Facts and information: Some find the established track record comforting for long-term planning.

8. Alvarium

Alvarium, headquartered in Auckland, New Zealand, connects clients to a global ecosystem of investment ideas while managing wealth for protection and growth. They provide advice tailored to personal values, effective for multi-generational families. Strengths are in their networked approach, offering unique opportunities from trusted sources.

The firm leads with forward-looking economic outlooks, incorporating macro trends. However, the focus on larger assets might sideline simpler client requirements. Alvarium's solutions integrate sustainability, appealing to conscious investors. Many value the emphasis on regional and global balance.

Key features: Custom investment strategies, advisory networks, outlook reports.

Facts and information: Many clients appreciate the connected opportunities for diversified growth.

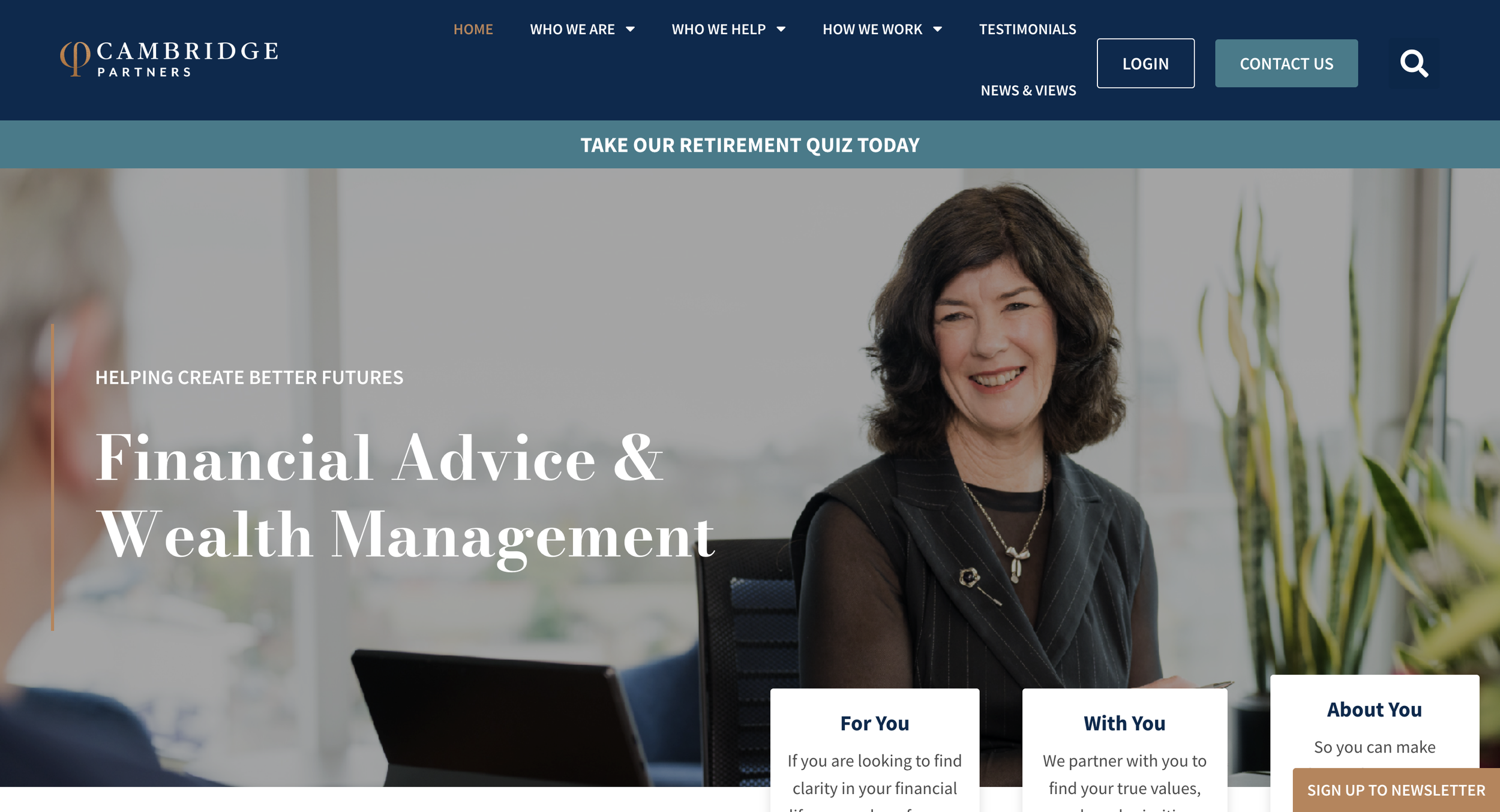

9. Cambridge Partners

Cambridge Partners, based in Christchurch, New Zealand, offers fee-only advice and portfolio management nationwide, specialising in holistic planning through life stages. They build custom portfolios with a focus on clarity and better futures. Strengths include their independent, fee-based model, ensuring unbiased recommendations. The team supports trusts and financial education, enhancing client empowerment. However, the southern base may limit in-person access for northern clients. Cambridge's approach addresses comprehensive needs, from accumulation to distribution.

Key features: Holistic financial tools, trust services, investment oversight.

Facts and information: Some note the fee-only structure promotes transparency.

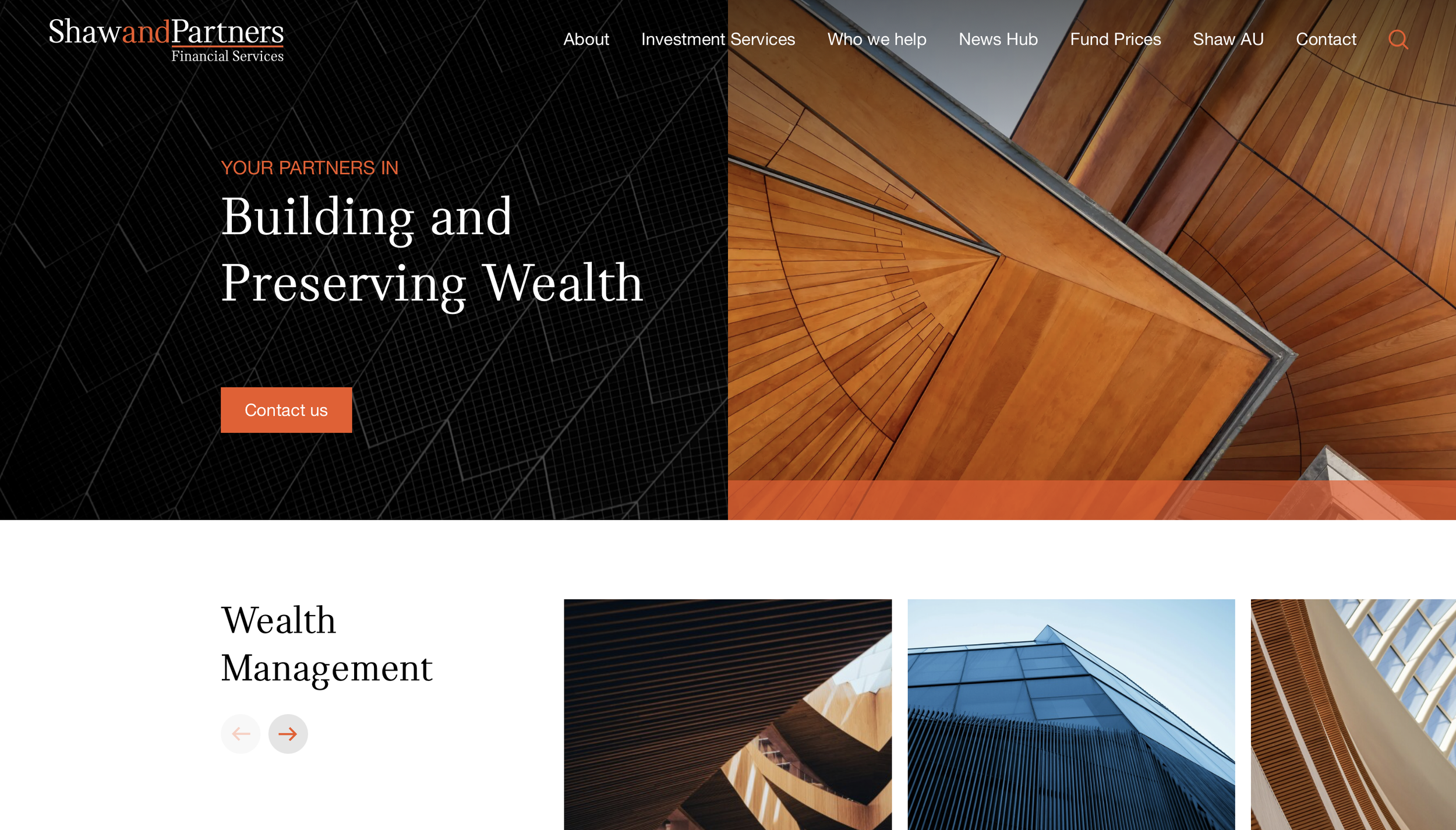

10. Shaw and Partners

Shaw and Partners, with a key presence in Auckland, New Zealand, concentrates on wealth building and preservation through managed portfolios and personal advice. They back strategies with research for informed choices. Strengths are in customisation and objective alignment, suitable for various investor levels. The firm offers discretion services for hands-off management. However, the structured methods might feel constraining in fluid scenarios. Shaw fosters long-term relationships, aiding sustained growth.

Key features: Personalised planning, research-backed decisions, self-select options.

Facts and information: Many seek them for relationship-oriented service.

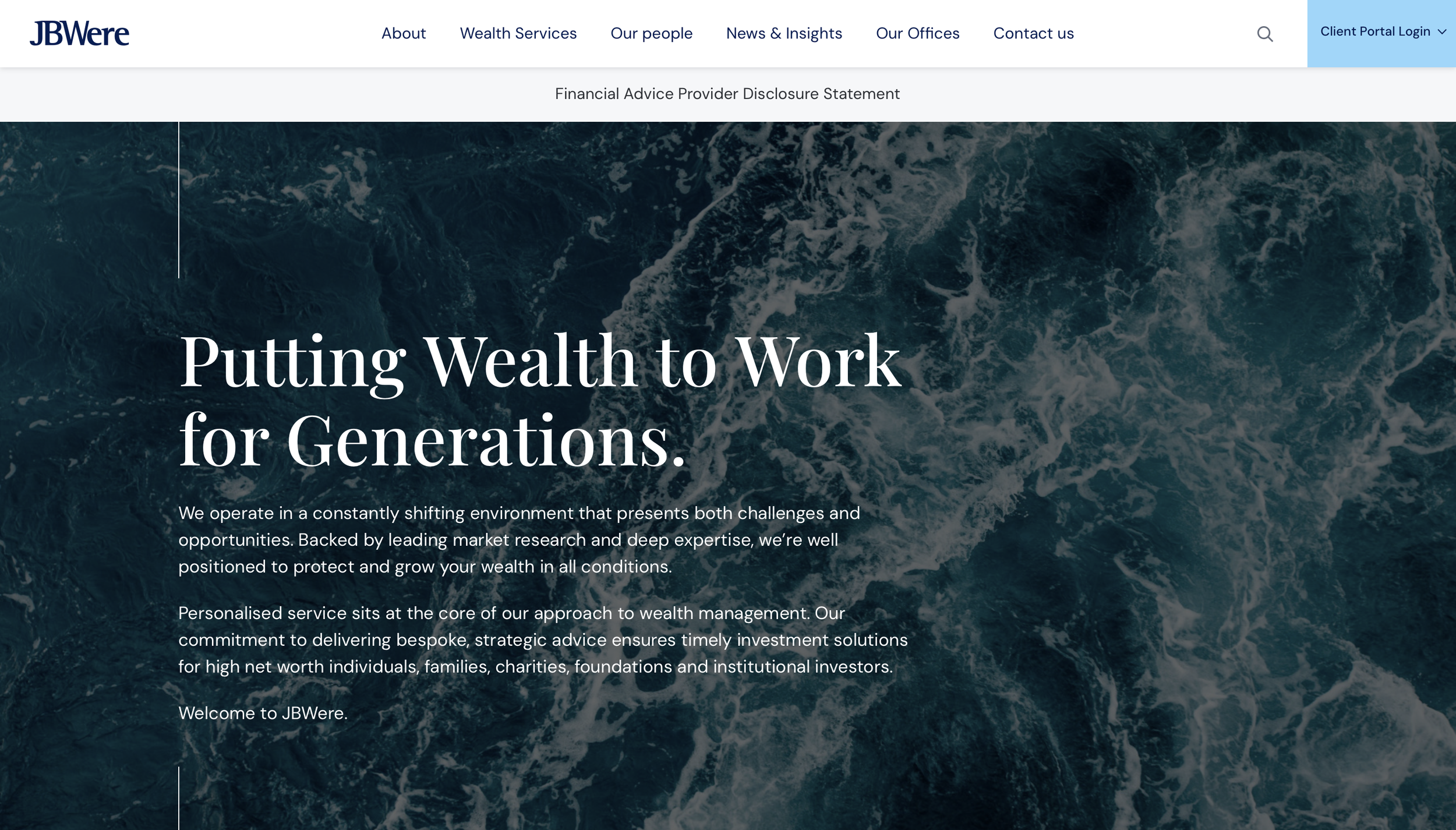

11. JBWere Private Wealth Management

JBWere Private Wealth Management, located in Auckland, New Zealand, provides high-end services for affluent clients, drawing from a heritage of premium advice. They offer tailored portfolios, estate planning, and access to exclusive opportunities. Strengths encompass their sophisticated tools for complex wealth structures, including philanthropy integration. The firm's alliance with global networks enhances diversification options.

They excel in serving business owners with succession strategies. A milder weakness is the premium focus, which might not suit mid-tier investors seeking basic guidance. JBWere's emphasis on discretion and privacy appeals to those valuing confidentiality. Many clients benefit from their proactive market navigation, ensuring portfolios remain resilient. Overall, they represent a refined choice for substantial assets, blending local acumen with international reach.

Key features: Estate and succession planning, philanthropic advisory, exclusive investment access.

Facts and information: Some appreciate the heritage for established trust in handling significant wealth.

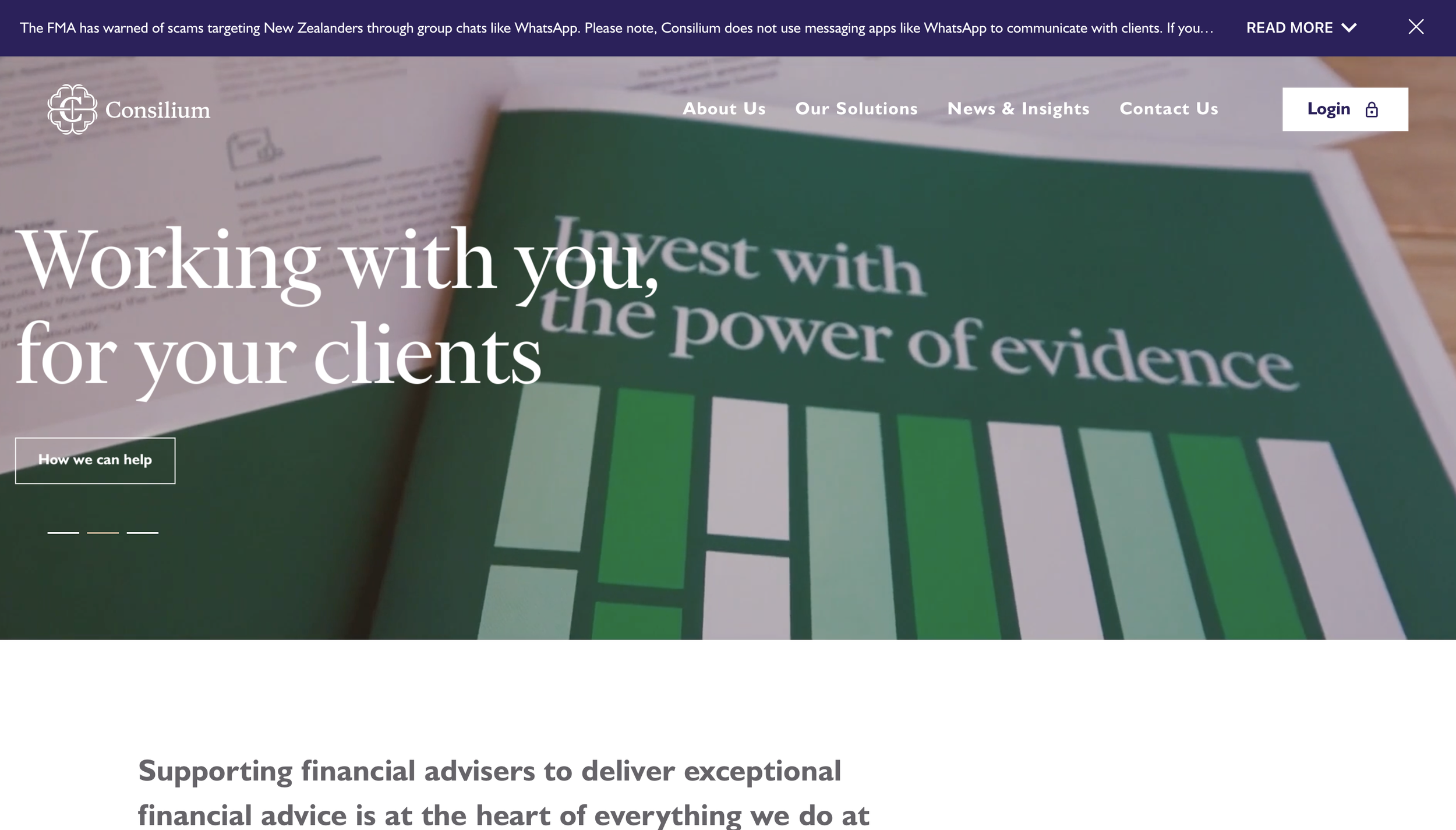

12. Consilium NZ

Consilium NZ, based in Auckland, New Zealand, supports independent advisers with platform solutions and manages assets for thousands of clients through partner firms. They champion professional advice with tools like wrap platforms. Strengths include their advanced technology for ESG profiling and portfolio modelling, aiding precise customisation.

The firm's New Zealand-owned status fosters alignment with local needs. They offer curated investment menus for robust strategies. However, the intermediary role can sometimes layer communication for end clients. Consilium's growth through partnerships expands service reach. Many value the innovation in advisory support.

Key features: Wrap platforms, model portfolios, ESG tools.

Facts and information: Many advisers rely on their infrastructure for efficient client management.

13. Private Wealth Advisers

Private Wealth Advisers, headquartered in Christchurch, New Zealand, is a boutique firm delivering specialist services to individuals, trusts, and organisations with a fee-only model. They prioritise transparency and independence in portfolio solutions. Strengths lie in their personalised, dynamic approach, selecting products solely for client benefit.

The team handles diverse entities like iwi and charities effectively. Custodial partnerships ensure secure management. A gentler drawback is the smaller scale, potentially limiting global reach compared to giants. Private Wealth Advisers build long-term ties through continuous knowledge updates. Many clients praise their passion and objectivity.

Key features: Fee-only advice, custodial transparency, specialist entity support.

Facts and information: Some highlight the boutique focus for intimate service.

14. Fisher Funds

Fisher Funds, situated in Auckland, New Zealand, specialises in KiwiSaver and investment management with a client-centric philosophy since 1998. They offer a range of funds aimed at growth and income. Strengths include their experienced team providing accessible education and straightforward strategies.

The firm integrates technology for easy account management. They cater to everyday Kiwis with simple entry points. However, the fund-focused model might offer less bespoke tailoring for ultra-high-net-worth needs. Fisher Funds' commitment to performance drives client loyalty. Many appreciate the local roots and transparency.

Key features: KiwiSaver plans, income funds, online portals.

Facts and information: Some value the educational resources for building financial literacy.

15. Generate Investment Management

Generate Investment Management, based in Auckland, New Zealand, focuses on KiwiSaver schemes with socially responsible tilts and growth options. They provide adviser-supported plans for personalised fit. Strengths are in their ethical investing emphasis, attracting value-aligned clients. The firm offers competitive structures with regular reviews.

They excel in retirement preparation through diversified holdings. A softer weakness is the KiwiSaver-centric approach, which may not cover full wealth advisory spectrum. Generate's model supports community initiatives. Many clients find the responsible focus refreshing.

Key features: Ethical KiwiSaver, adviser networks, performance tracking.

Facts and information: Many turn to them for aligning investments with personal values.

16. Booster

Booster, located in Wellington, New Zealand, delivers KiwiSaver and investment solutions with a cooperative ethos, owned by members. They offer diverse funds including private markets access. Strengths include their innovative inclusions like wine investments, adding unique diversification. The firm prioritises member benefits through low-fee structures. They provide tools for goal setting. However, the member-owned setup might introduce governance layers affecting speed. Booster's approach fosters inclusivity. Many appreciate the alternative asset exposure.

Key features: Private market funds, goal-based planning, member perks.

Facts and information: Some highlight the cooperative model for shared success.

17. Simplicity

Simplicity, headquartered in Auckland, New Zealand, operates as a non-profit KiwiSaver provider with low-cost index funds and mortgages. They focus on passive strategies for broad market exposure. Strengths lie in their fee efficiency, appealing to cost-conscious investors. The non-profit status ensures returns go to members. They offer straightforward, transparent products. A milder issue is the passive focus, which may not suit active return seekers. Simplicity's model promotes accessibility. Many value the simplicity in design.

Key features: Low-cost indexing, mortgage options, transparent reporting.

Facts and information: Many seek them for hassle-free, affordable saving.

18. Kernel Wealth

Kernel Wealth, based in Auckland, New Zealand, provides digital investment platforms with ETF-style funds for easy diversification. They target tech-savvy investors with low barriers. Strengths include their user-friendly app and focus on sustainable themes. The firm enables fractional investing for broader access. They integrate data analytics for informed choices. However, the digital-first approach might lack depth in personal advice for complex cases. Kernel's innovation drives engagement. Many appreciate the modern interface.

Key features: ETF portfolios, sustainable funds, app-based management.

Facts and information: Some find the tech integration simplifies investing.

19. Salt Funds Management

Salt Funds Management, situated in Auckland, New Zealand, offers active investment strategies across equities and fixed income for institutional and retail clients. They provide market outlooks and diversified funds. Strengths are in their research depth, aiding outperformance pursuits. The firm collaborates on macro insights. They cater to sophisticated needs with alternative options. A gentler weakness is the active style's higher volatility potential. Salt's expertise supports strategic planning. Many value the analytical rigor.

Key features: Active equity funds, fixed income strategies, market commentaries.

Facts and information: Many rely on their insights for navigating trends.

20. Devon Funds Management

Devon Funds Management, based in Auckland, New Zealand, specialises in active New Zealand and Australian equity funds with a value-oriented approach. They serve investors seeking regional focus. Strengths include their specialised knowledge of trans-Tasman markets, enhancing targeted growth. The firm offers KiwiSaver integration. They emphasise disciplined investing. However, the regional concentration might limit global diversification. Devon's track record builds confidence. Many appreciate the focused expertise.

Key features: Equity-focused funds, value investing, regional insights.

Facts and information: Some highlight the trans-Tasman emphasis for localised opportunities.

Trends Shaping Wealth Management in 2026

Technology plays a bigger role, with apps and platforms making tracking easier for clients. Sustainability gains traction, as more firms incorporate ethical investments that match values without sacrificing returns. Global events influence local markets, so advisers stress resilience through varied assets. In New Zealand, regulatory shifts encourage transparency, benefiting those who prioritise client education.

Benefits of Professional Wealth Management

Hiring experts saves time, as they handle market monitoring and adjustments.

It reduces stress by offering objective views during uncertain periods.

Custom plans often lead to more efficient tax handling and legacy preparation.

For Kiwis, this means better integration with local schemes like superannuation transfers.

How to Get Started with Wealth Management

Begin by reviewing your current finances, noting assets and goals. Meet with advisers to compare approaches, asking about their independence and tools. Set clear expectations for communication and reviews. Starting small, like with a portfolio assessment, builds confidence before full commitment.

FAQ

What is wealth management?

Wealth management combines investment advice with broader financial planning to help individuals organise and grow their assets over time. It addresses various aspects such as cashflow management, tax considerations, and legacy planning to create a cohesive strategy. This service adapts to changing circumstances, offering guidance that supports both short-term needs and long-term aspirations.

How do I choose the best wealth management solution for me?

Start by identifying your primary goals, whether focusing on growth, income, or preservation. Seek providers that emphasise independence and offer access to a wide range of investment options. The right solution provides clear communication and regular updates to ensure alignment with your evolving situation.

What role does KiwiSaver play in wealth management?

KiwiSaver acts as a core component of retirement savings, benefiting from employer contributions and potential government incentives. It can be tailored through fund selection to match your risk tolerance and time horizon. When integrated into a wider plan, it enhances overall financial security and growth potential.

Can wealth management help with overseas pensions?

Wealth management supports the handling of UK pension transfers or Australian super transfers by managing regulatory requirements and currency considerations. This process consolidates assets for easier oversight and integration. Professional assistance ensures smooth transitions while addressing compliance matters.

Is wealth management suitable for individuals at different life stages?

Wealth management adapts to various stages, from early career savings to mid-life wealth building and retirement transitions. It offers scalable services that address specific needs like debt management or family provisions. This flexibility makes it valuable for building and maintaining financial well-being throughout life.

Read Also:

Discover the Best Wealth Management Solutions in 2026 - Compound Wealth