Loss Aversion: Why It Could Be Hurting Your Investments

We humans are funny creatures. When it comes to money, we feel the pain of losing much more strongly than we feel the joy of winning. This tendency is called loss aversion, and it’s one of the biggest reasons many investors underperform the market.

What is loss aversion?

Loss aversion is a cognitive bias where losses loom larger than gains. Put simply, losing $100 hurts far more than winning $100 feels good.

This mindset is deeply instinctual—we’re hard-wired to avoid pain and protect what we already have. Unfortunately, that instinct doesn’t always serve us well in investing. Markets go up and down, and if we let short-term losses dictate our behaviour, we risk missing out on the long-term rewards.

A real-world example: fear keeping investors out of markets

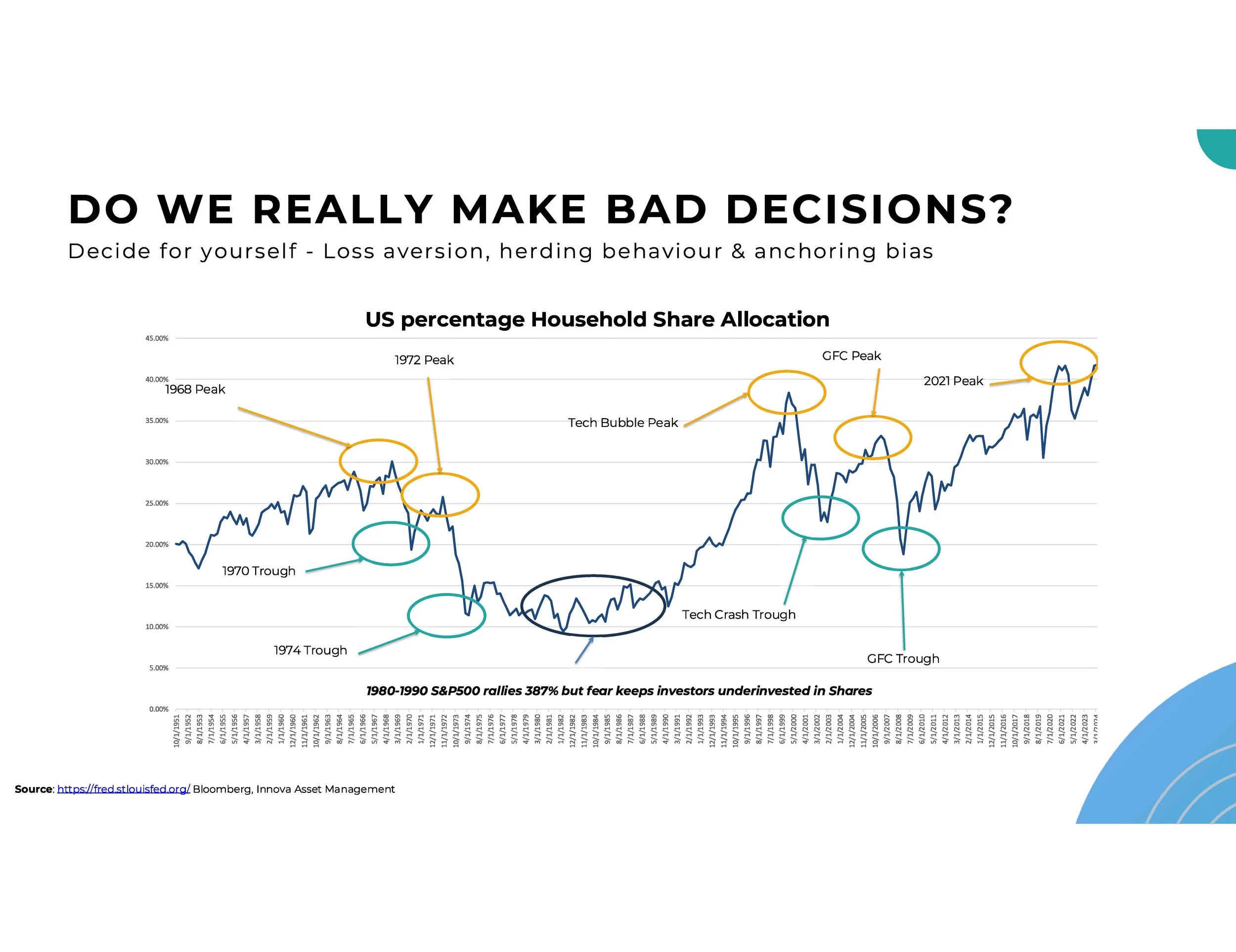

Between 1980 and 1990, the US share market (S&P 500) returned an incredible 387%. Yet despite these gains, household ownership of shares barely increased. Why? Many investors were still traumatised by the market crashes of the 1970s and avoided re-entering the market out of fear it would happen again.

This is the destructive side of loss aversion: investors missed out on huge long-term returns because past pain weighed heavier than future potential.

How loss aversion shows up in investing

Over-conservatism: Sticking to very safe investments to avoid risk, even when it means lower returns.

Panic selling: Selling investments during market dips to “stop the bleeding,” locking in losses instead of riding out the recovery.

Reluctance to invest: Waiting too long to put money into growth assets like shares, despite their importance for long-term wealth.

The chart below illustrates this pattern repeating again and again over decades, with investors piling into markets at peaks and retreating after crashes.

How to beat loss aversion

The good news? You can structure your investment approach to reduce the impact of emotional biases like loss aversion.

Take a long-term perspective – Markets are volatile in the short run, but patient investors are rewarded over decades.

Stick to your plan – Anchor decisions around your goals and strategy, not today’s headlines.

Automate your investing – Using tools like dollar-cost averaging keeps your contributions steady through ups and downs.

Stop checking your balance – Checking your KiwiSaver or investment account too often makes every dip feel dramatic.

The takeaway

Loss aversion is natural, but it doesn’t have to dictate your financial future. By recognising it and building discipline into your investment strategy, you can stop fear of loss from holding you back and instead focus on the long-term gains that really matter.

Compound Wealth are based in Mount Maunganui, Tauranga and offer KiwiSaver, Investment & Retirement Financial Advice to clients all over New Zealand.