5 Mistakes That Could Cost You $100K in KiwiSaver

KiwiSaver is one of the easiest tools to grow long-term wealth but also one of the easiest to ignore. And a few small missteps along the way can end up costing you tens or even hundreds of thousands of dollars by the time you retire.

Here are five costly KiwiSaver mistakes we see far too often and how you can avoid them.

1. Staying in the Wrong Fund for Too Long

A common error is being too conservative for too long. Many Kiwis are still in default or cautious funds years after signing up without realising it could be costing them hundreds of thousands over time.

Just look at this chart below comparing growth across different fund types. The aggressive fund (dark blue) significantly outperformed more conservative options over time. That’s the power of being in the right fund for your age and goals.

If you’ve got time until retirement, consider whether a growth or aggressive fund is a better fit.

📊 Growth of Contributions in Differing Risk Levels ($1,000/month over time: Cautious vs Balanced vs Aggressive)

2. Stopping Contributions Altogether

Paused contributions? You're not just missing out on investment growth you’re also forgoing employer contributions, Government contributions, and the power of compounding.

Even short breaks in contributions can set you back tens of thousands of dollars.If you’re under financial pressure, reduce your contributions instead of stopping. Even 3% keeps things ticking.

3. Missing the Government Contribution

From 1 July 2025, the Government KiwiSaver top-up is being halved:

You’ll get 25¢ per $1, up to $260.72 per year.

You still need to contribute at least $1,042.86 to get the maximum.

If you earn more than $180,000, you’ll no longer be eligible for Government Contributions.

16 and 17 year olds will now qualify too.

Over a few decades, that’s around $7,800 in free money if you qualify and that’s before any investment growth.

4. Withdrawing for a First Home Without a Plan

Using KiwiSaver to buy your first home is a great opportunity but many people stop there. They withdraw their balance, stay in a conservative fund, and contribute the bare minimum without revisiting their plan.

That’s a recipe for a low retirement balance. After buying your home, reset your KiwiSaver strategy. Review your fund, contribution rate, and goals.

5. Set and Forget Thinking

Markets change. So does your life. Yet many people never revisit their KiwiSaver settings after joining.

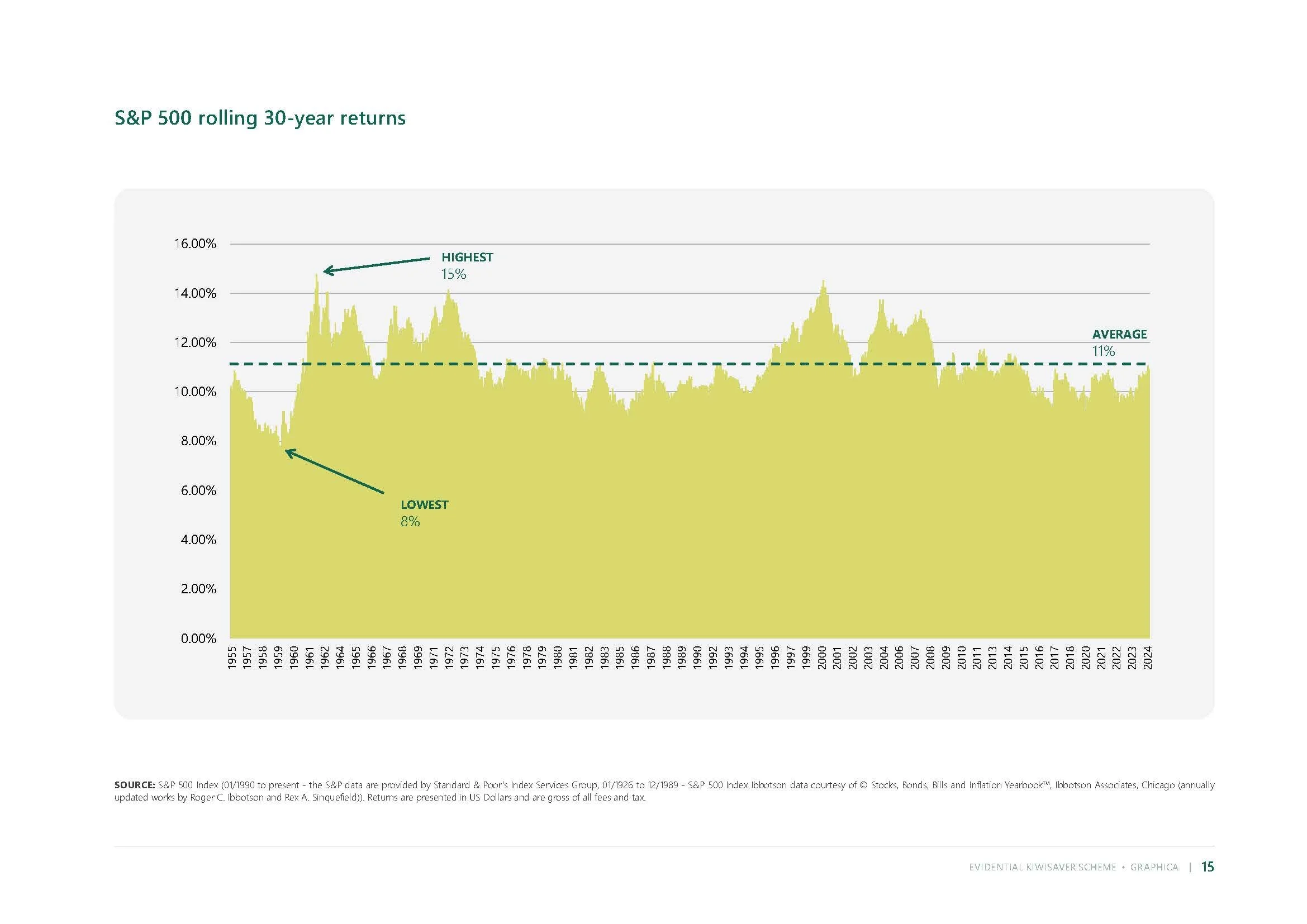

That’s fine, until it isn’t. Here’s why staying the course in a well-suited fund is so powerful. Even the worst 30-year stretch delivered 8% per year, and the average is around 11%. That’s the reward for staying invested and not trying to time the market.

Review your KiwiSaver at least once a year or after major life changes. Make sure your fund, provider, and contribution rate still align with where you’re heading. If you’re a Compound Wealth Client, we’ll notify you when you’re KiwiSaver is due for an annual review.

Our next steps

Avoiding these five mistakes could easily boost your KiwiSaver by $100K or more.

It’s not about being perfect. It’s about checking in once a year, making small adjustments, and letting time and compound returns do the heavy lifting.

Want to see what your KiwiSaver could look like at retirement?

Get your complimenaty KiwiSaver report tailored to your income, ideal retirement age, and risk appetite.

We’ll show you:

Your projected retirement balance

Whether your current fund fits your goals

What a smarter fund could do for your future